Advanced Order Flow Trading Course

Find out what successful traders know about order flow

Learn what I teach in personal one-on-one training sessions with other traders

Dig Deeper Into Order Flow Analysis As Taught By An Institutional Trader

If you don't know me by now, my name is Michael Valtos and in my over 25 years of live market experience trading at some of the biggest banks and commodity trading companies in the world. I spent 8 years trading at JP Morgan, 4 years at Cargill, 3 years at Commerzbank and 2 years at EDF Man. This is a tremendous opportunity to learn from an experienced trader with a solid foundation of market knowledge gained from working at some of the world's biggest trading institutions.

The Advanced Order Flow Trading Course teaches you time tested and proven methods of order flow analysis.

The Advanced Order Flow Trading Course teaches you time tested and proven methods of order flow analysis.

So if you haven't heard, what's working NOW when competition is higher than ever, is order flow.

I personally know order flow works because that is what made me a successful trader at JP Morgan for 8 years and Cargill for 4 years. Since I launched the Orderflows Trader software in 2015, I have taught thousands of traders how to properly read, understand and apply order flow to the market.

Traders who wanted to take their trading to a higher level have paid me thousands of dollars to personally work one-on-one with them to improve their order flow knowledge and trading in general.

However, I wanted to help more traders but realized there is only so many hours in a day. So I decided to created the Advanced Order Flow Trading Course to reach more traders.

Who will benefit the most from the Advanced Order Flow Trading Course?

Traders who already understand order flow but want to know what is working right now.

Traders looking to get an edge over other traders.

Traders who want to learn to manage their trades better using order flow.

Traders who want to learn how to keep out of bad trades instead of taking them.

Traders who have a strong desire to improve their trading results.

And many, many more will benefit.

If you are interested in becoming a better trader with just a small investment, you can.

I personally know order flow works because that is what made me a successful trader at JP Morgan for 8 years and Cargill for 4 years. Since I launched the Orderflows Trader software in 2015, I have taught thousands of traders how to properly read, understand and apply order flow to the market.

Traders who wanted to take their trading to a higher level have paid me thousands of dollars to personally work one-on-one with them to improve their order flow knowledge and trading in general.

However, I wanted to help more traders but realized there is only so many hours in a day. So I decided to created the Advanced Order Flow Trading Course to reach more traders.

Who will benefit the most from the Advanced Order Flow Trading Course?

Traders who already understand order flow but want to know what is working right now.

Traders looking to get an edge over other traders.

Traders who want to learn to manage their trades better using order flow.

Traders who want to learn how to keep out of bad trades instead of taking them.

Traders who have a strong desire to improve their trading results.

And many, many more will benefit.

If you are interested in becoming a better trader with just a small investment, you can.

Get The Advanced Order Flow Trading Course Now For Just $299

Once your payment has been processed, the Advanced Order Flow Trading Course login information will be sent to your PayPal registered email. That is the email you used for your PayPal transaction. All emails are usually sent within 3-6 hours. If you still haven't received it after then, please check your SPAM folder.

What You Will Learn In The Advanced Order Flow Trading Course

Module 1 - Principles Of Order Flow

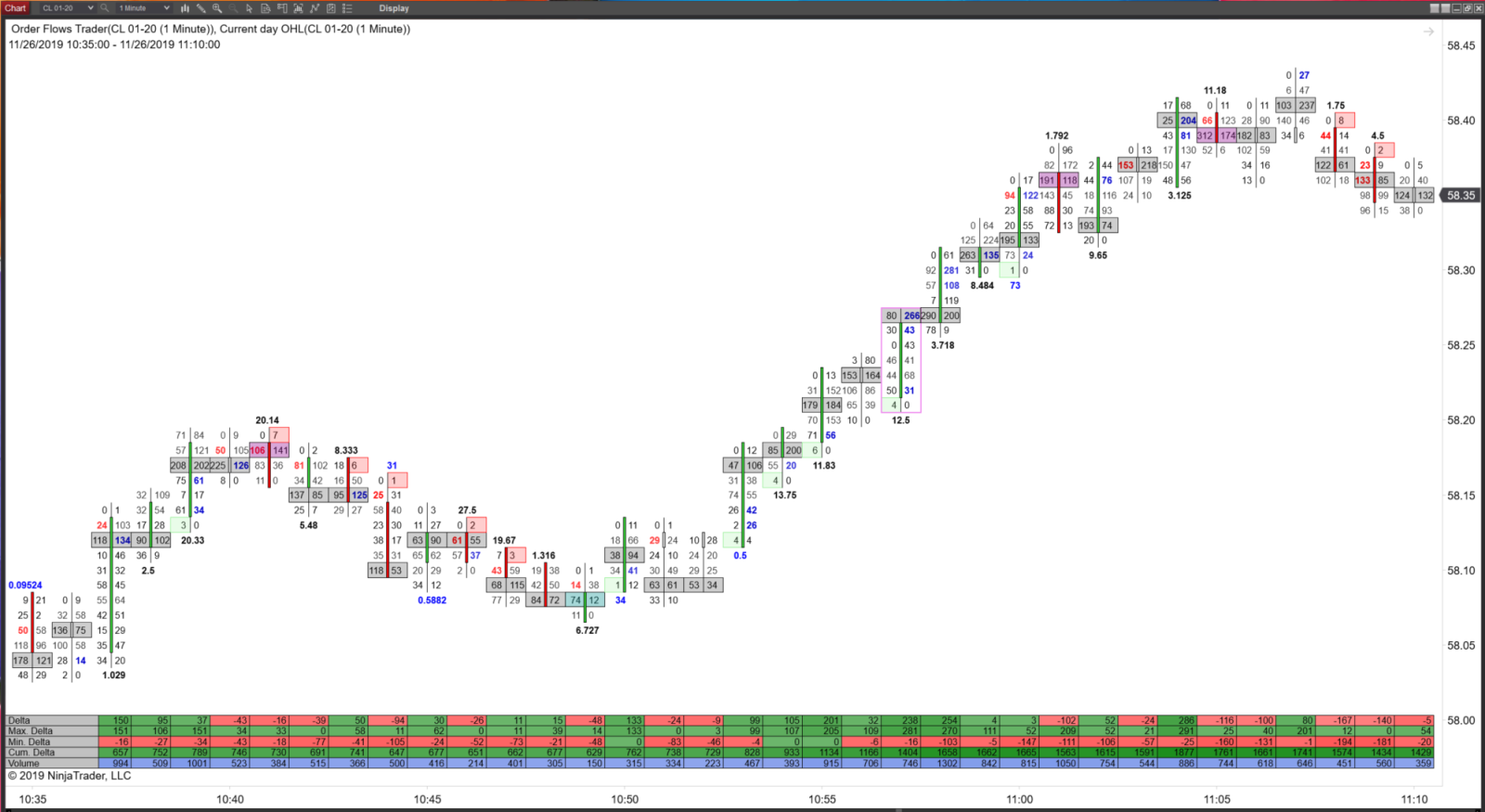

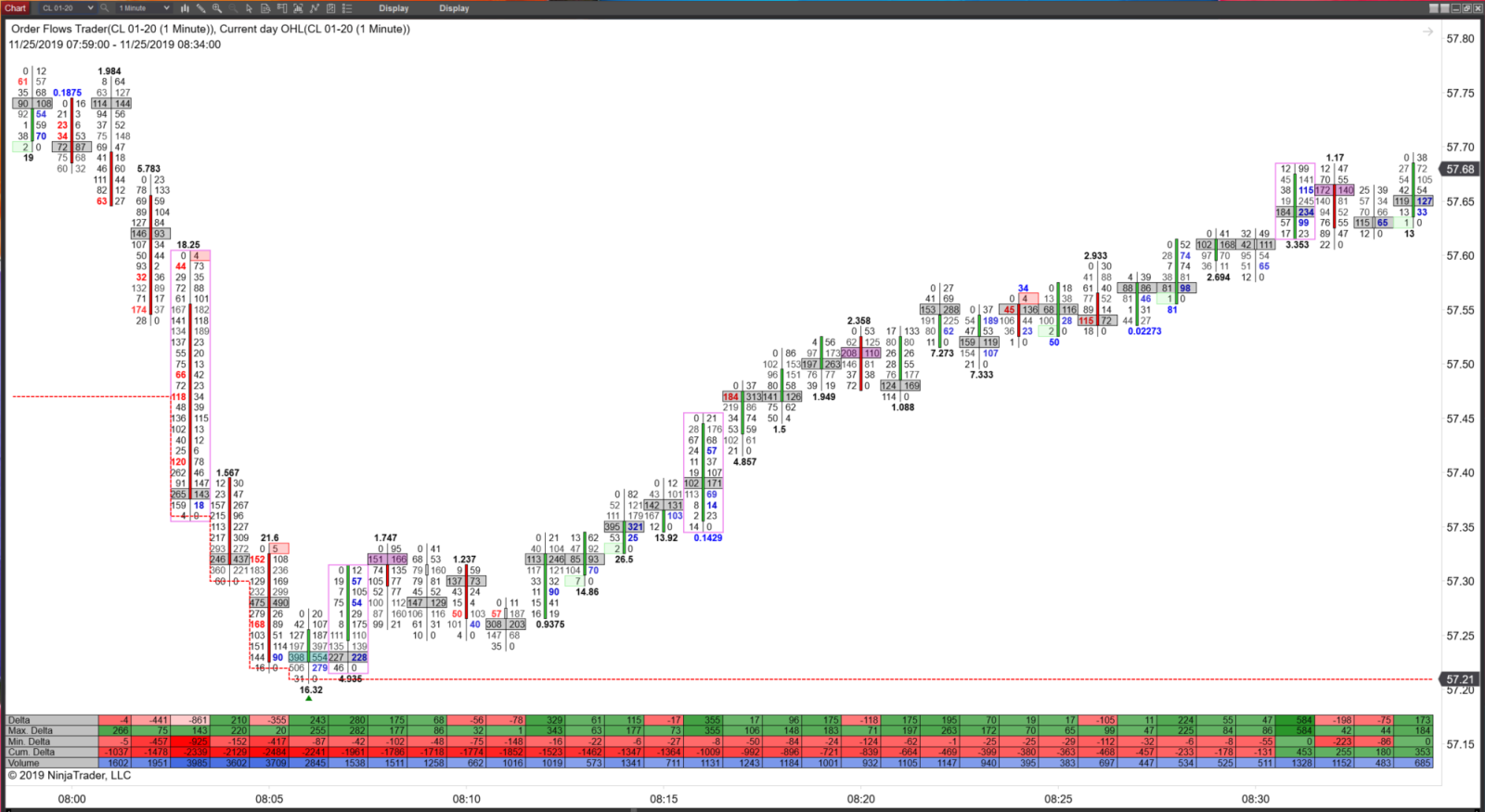

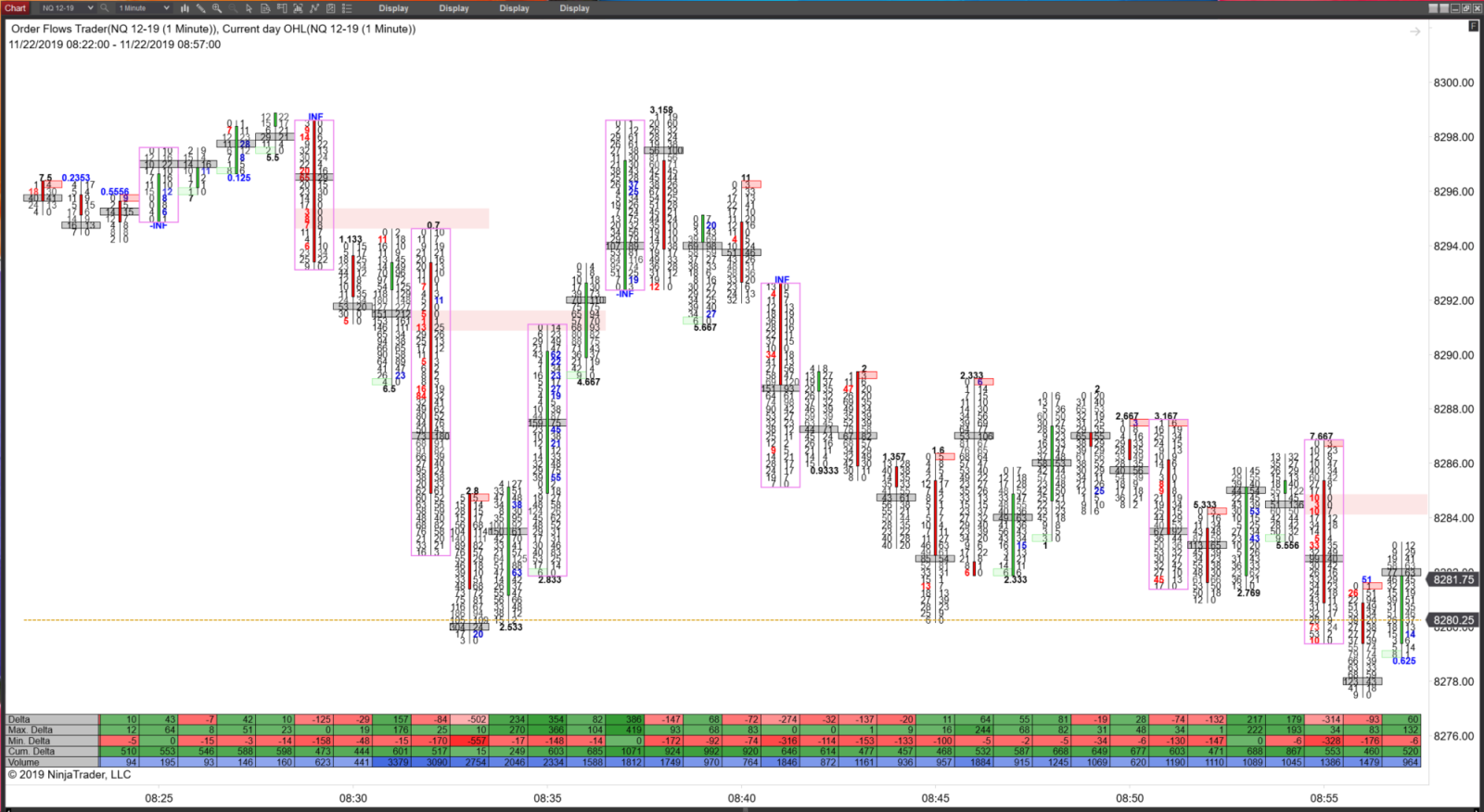

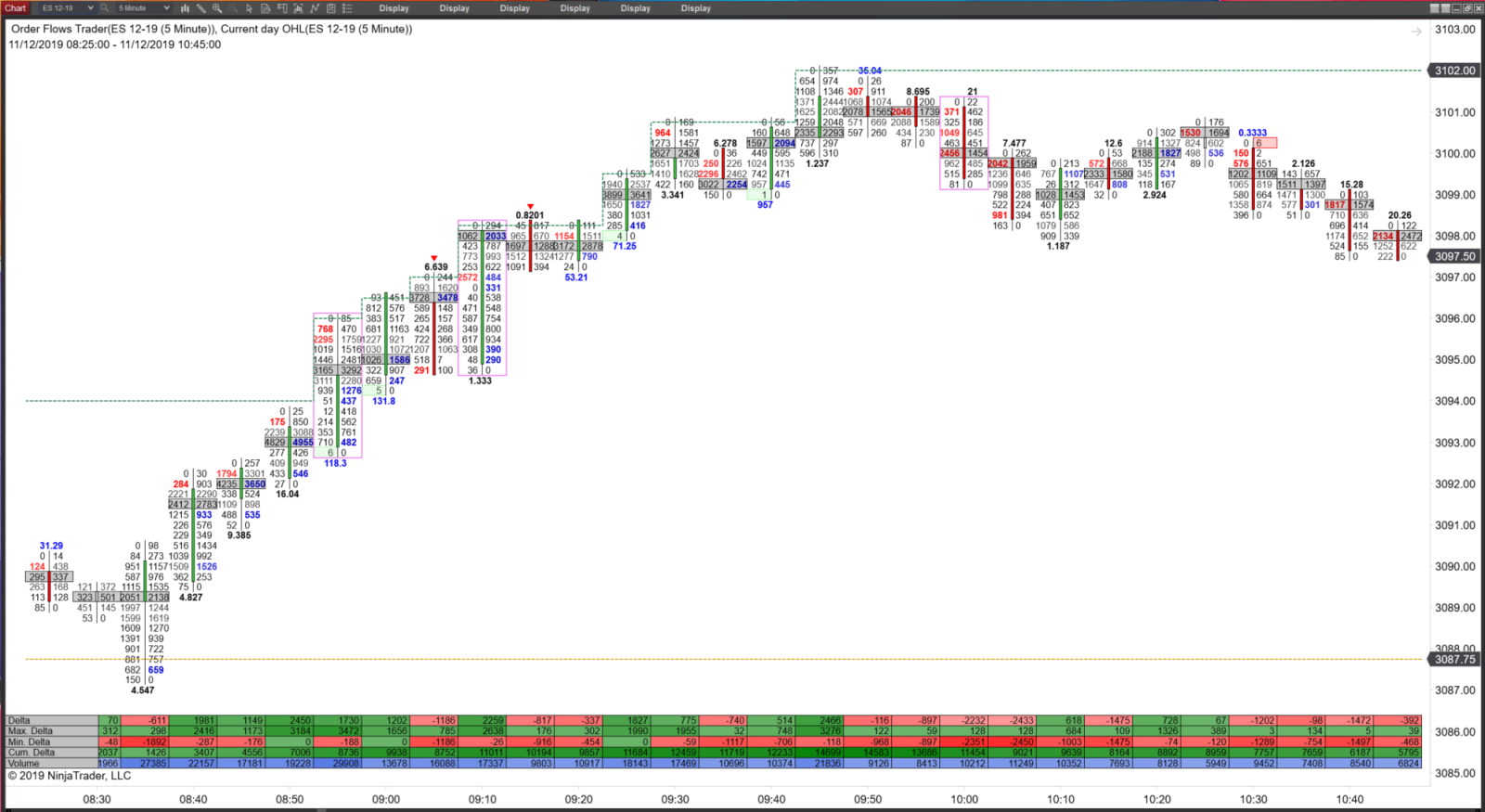

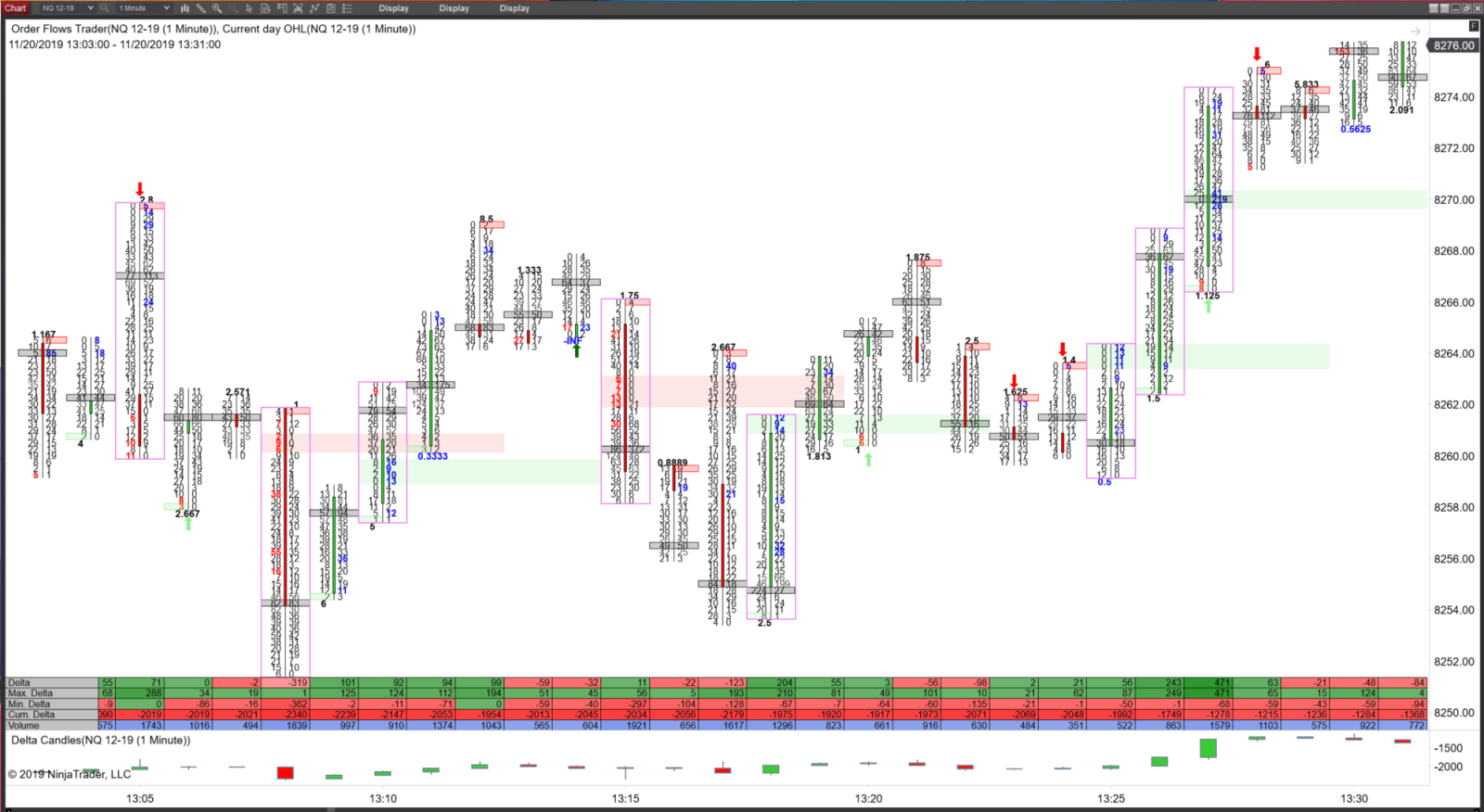

This module takes you beyond just the basics of order flow. Let's be honest, if you are using this course you already the basics of order flow. You will learn the advanced principals of order flow. Once you know what delta, imbalances and points of control are and their importance you have to know how to apply those pieces with other market data such as price and volume.

Module 2 - Finding The Order Flow Honey Hole

A honey hole is a term hunters and fisherman use to describe a location that they have a good chance of finding a fish or animal they can catch to eat. It is their go to place when they need results. In trading terms, in terms of the market it would be a location where the trader has potential for catching a nice big move.

Module 3 - Trading The Cash Open

The cash open is one of the most important times of the day for institutional traders and there are clues as to what type of day you can be in for. It can be a trending day or it could be a rotational day. That is important because you know you can't trade a trending day the same way you trade a rotational day. Just as important, the cash open will help you find important levels the market can retrace back to as support or resistance.

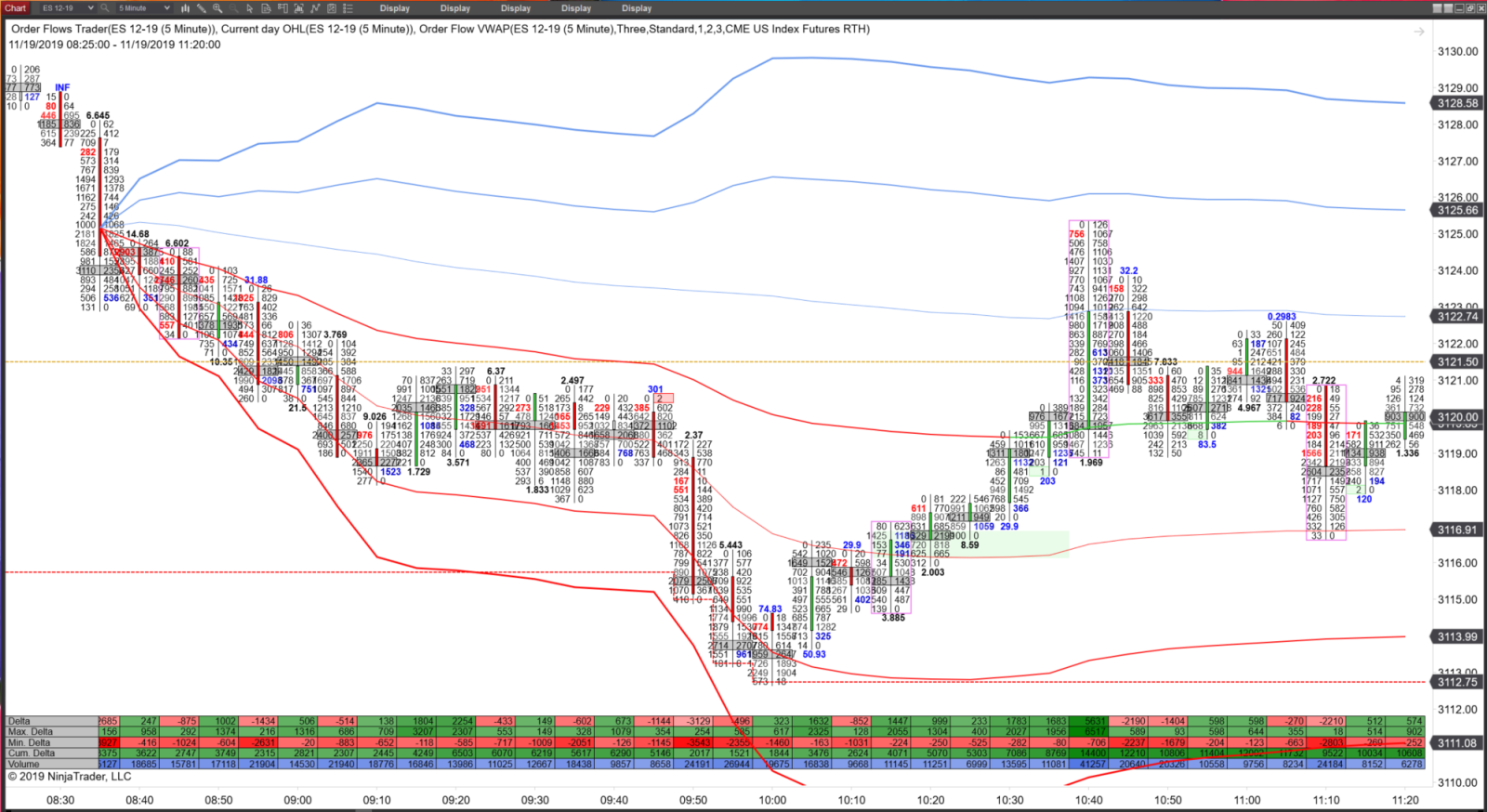

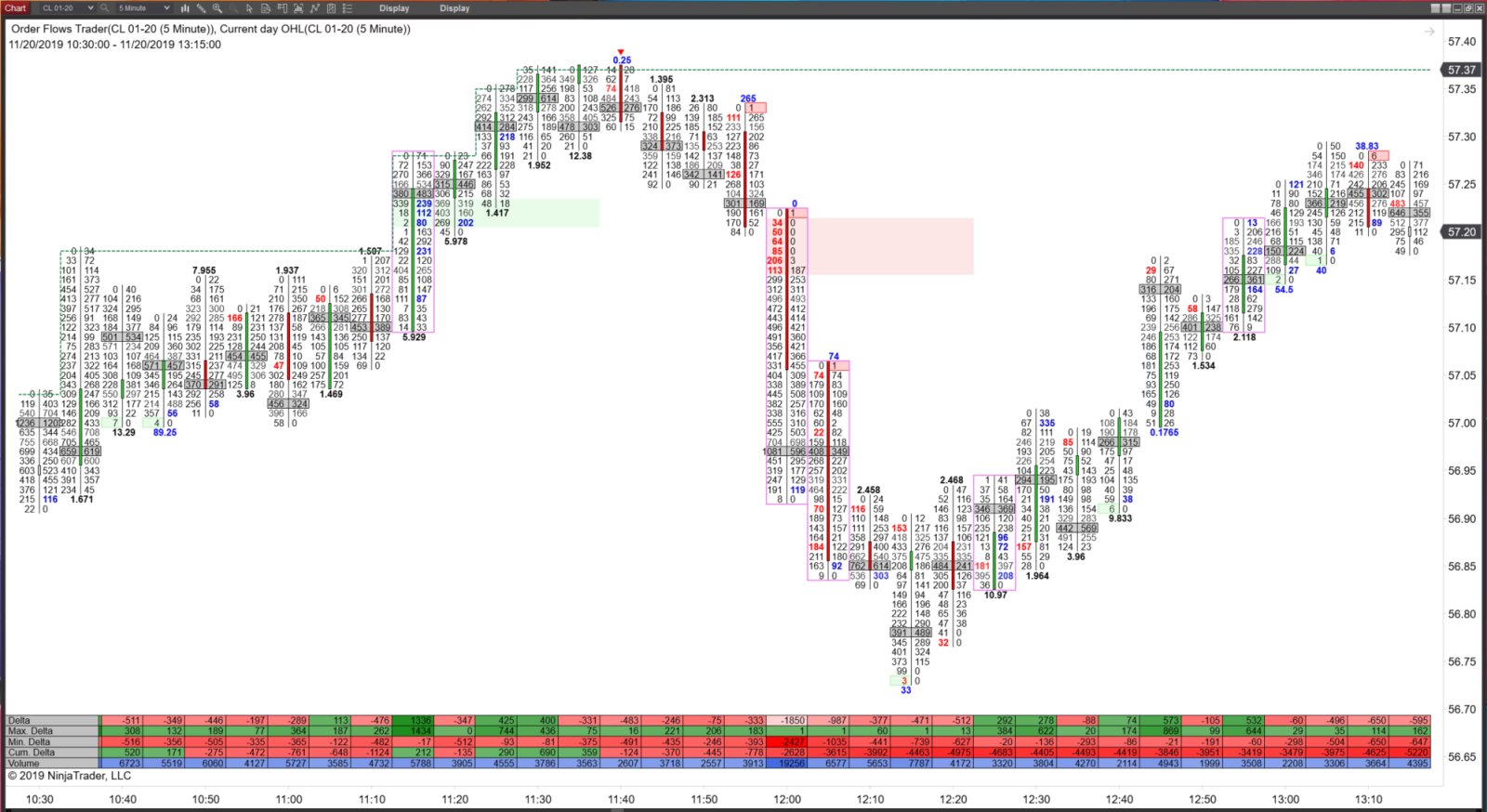

Module 4 - Trading Around VWAP

VWAP, Volume Weighted Average Price, for many traders is a new tool for trading. Unfortunately, many traders are using VWAP without understanding its limitations and why it is used by institutional traders. When I was working at JP Morgan I had to target VWAP on some of my orders and at times I was graded on how well I traded around VWAP. Most retail traders and those who have never had to actually trade around VWAP look at it as if it were some magical level that the market must trade around which it is not. In this module I discuss some of the limitations of VWAP, how to trade around VWAP and discuss trade opportunities that VWAP presents.

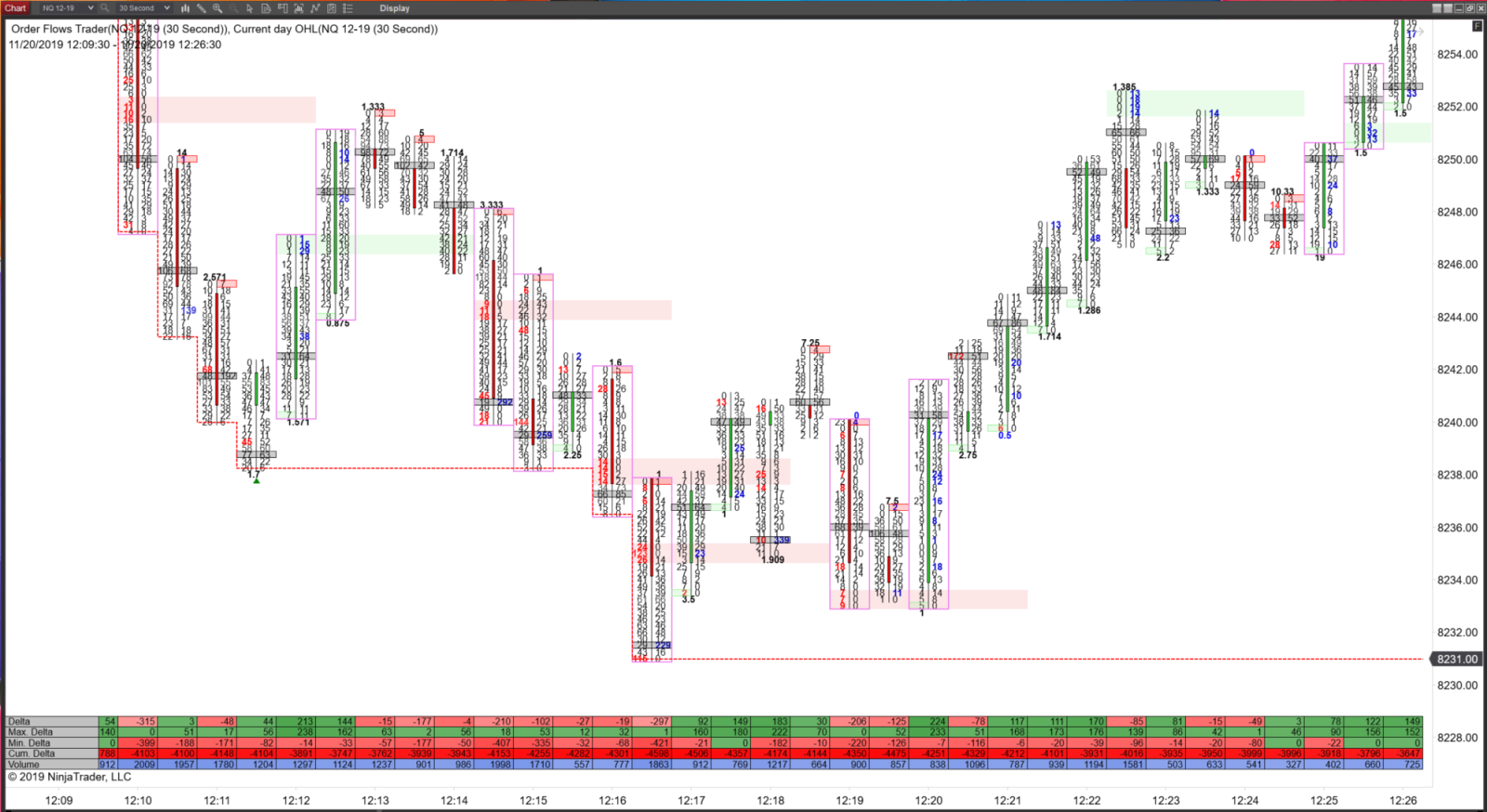

Module 5 - Order Flow Relationships

Most traders just rely solely on price in determining whether to take it trade. But price is just one aspect of market generated data available to a trader, so why limit yourself, why contain yourself? There is other valuable data a trader can use in their analysis, such as volume, and when you dig deeper, you can even break it down to not only volume at price, but also

volume traded on the bid and volume traded on the offer. In this module I discuss the different relationships that exist in the market that you can benefit from by adding it to your analysis.

volume traded on the bid and volume traded on the offer. In this module I discuss the different relationships that exist in the market that you can benefit from by adding it to your analysis.

Module 6 - Order Flow Nuances

In this module I am going to be explaining different nuances that occur in the order flow. These are not necessarily things you are going to see happening every day in a market, but when you do see them happening it is in your best interest to understand what is happening and why it is happening, so you don’t get caught offside.

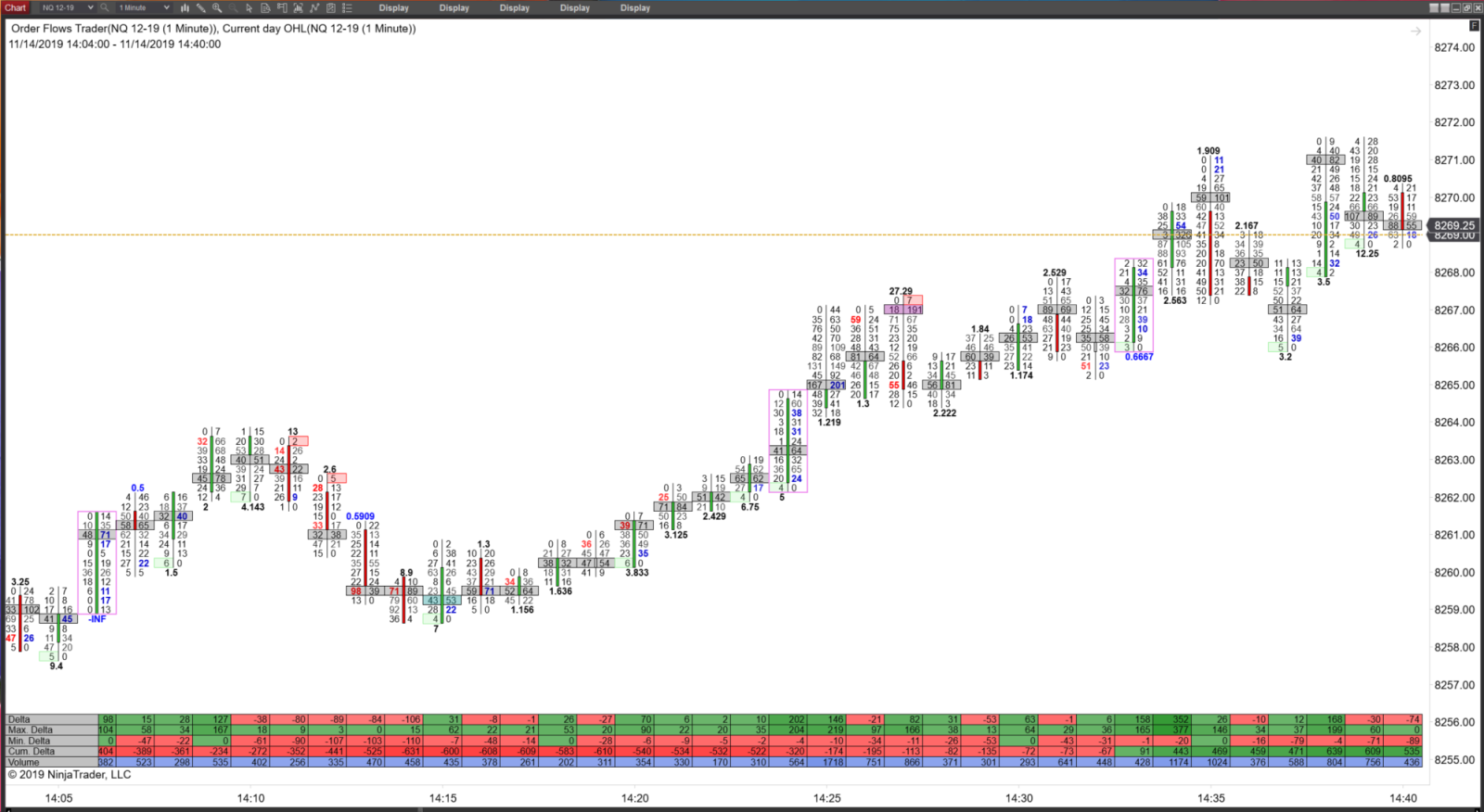

Module 7 - Active Trade Entry

Many traders struggle when it comes time to get into a trade. Unsuccessful traders miss a lot of the trades they should take because they are afraid when it comes time to actually take the trade while other traders take trades they shouldn't be taking. You are darned if you do, darned if you don't. It's not just overtrading that stymies traders, but also undertrading. Never heard of undertrading, it is basically the fear of taking a loss so you don't take the trade. I am going to share with you a method I use to eliminate that issue.

Module 8 - Active Trade Management

Trading order flow gives you the ability to actively manage a trade once you are in. One of the reasons many traders fail to make money over time is they live by an all or nothing mentality, meaning they are going to let the trade either go to their take profit or to their stop. This runs contrary to the most important rule of trading which is cut your losses short and let your winners run. How are you going to cut your losses short if you don't manage your trade. Letting it either stop you out or hit your target is not actively managing your trade. In this module, I take you through reading the order flow to get out of trades early for a small loss or break-even when you are not getting paid. Also you will learn how to read the order flow to ride trades longer.

Module 9 - Order Flow Trade Setups

In this module I discuss 11 different trade setups that you can use in your trading. As a trader, you have to know what you are looking for in the order flow and apply it to the market. If you are able to add just one or two of the order flow trade setups explained in this module to your trading plan, along with active trade entry and active trade management you can vastly improve your trading results. I go through 11 different order flow trade setups, but you need to use the setups that resonate most with yourself, the setups that you understand that help you understand the market.

Module 10 - Pragmatic Trading

Trade what you see, not what you feel. The market offers a trader so much information that at times it feels overwhelming. However, you will see that there are certain patterns in the order flow that repeat over and over with the same results. In this module, I put together and wrap up what I taught your in the earlier modules so that you can go forward and apply it to your own trading.

Get The Advanced Order Flow Trading Course Now For Just $99

Once your payment has been processed, the Advanced Order Flow Trading Course login information will be sent to your PayPal registered email. That is the email you used for your PayPal transaction. All emails are usually sent within 3-6 hours. If you still haven't received it after then, please check your SPAM folder.

Copyright 2019 | Orderflows.com | All rights reserved

- Disclaimer

HYPOTHETICAL PERFORMANCE DISCLAIMER:HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

©Orderflows.com

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..