Learn To Read The Order Flow In Crypto Markets

The Crypto Order Flow Trading Course

Order flow is the only tool available that shows traders how volume impacts price.

Hi, my name is Michael Valtos and I spent 25 years as an institutional trader at JP Morgan, Cargill, Commerzbank, EDF Man and Dean Witter Reynolds. The one thing that I have found to be single most important part of market analysis is order flow because it gets you as close to the market as possible so you can best analyze what is happening in the market and, more importantly, why its happening in the market.

I got involved in crypto markets a few years ago because I was looking into alternative ways to accept payments and bitcoin fascinated me. I quickly realized it was great for trading and not just for processing payments or transferring money. However, at the time, my style of trading (order flow analysis) just wasn't feasible based on the technology at the time (2016-2017). However, fast forward to 2020 and the technology finally started to catch up. Now, in 2022, more and more crypto exchanges are opening up their API for trading software companies to connect to.

I got involved in crypto markets a few years ago because I was looking into alternative ways to accept payments and bitcoin fascinated me. I quickly realized it was great for trading and not just for processing payments or transferring money. However, at the time, my style of trading (order flow analysis) just wasn't feasible based on the technology at the time (2016-2017). However, fast forward to 2020 and the technology finally started to catch up. Now, in 2022, more and more crypto exchanges are opening up their API for trading software companies to connect to.

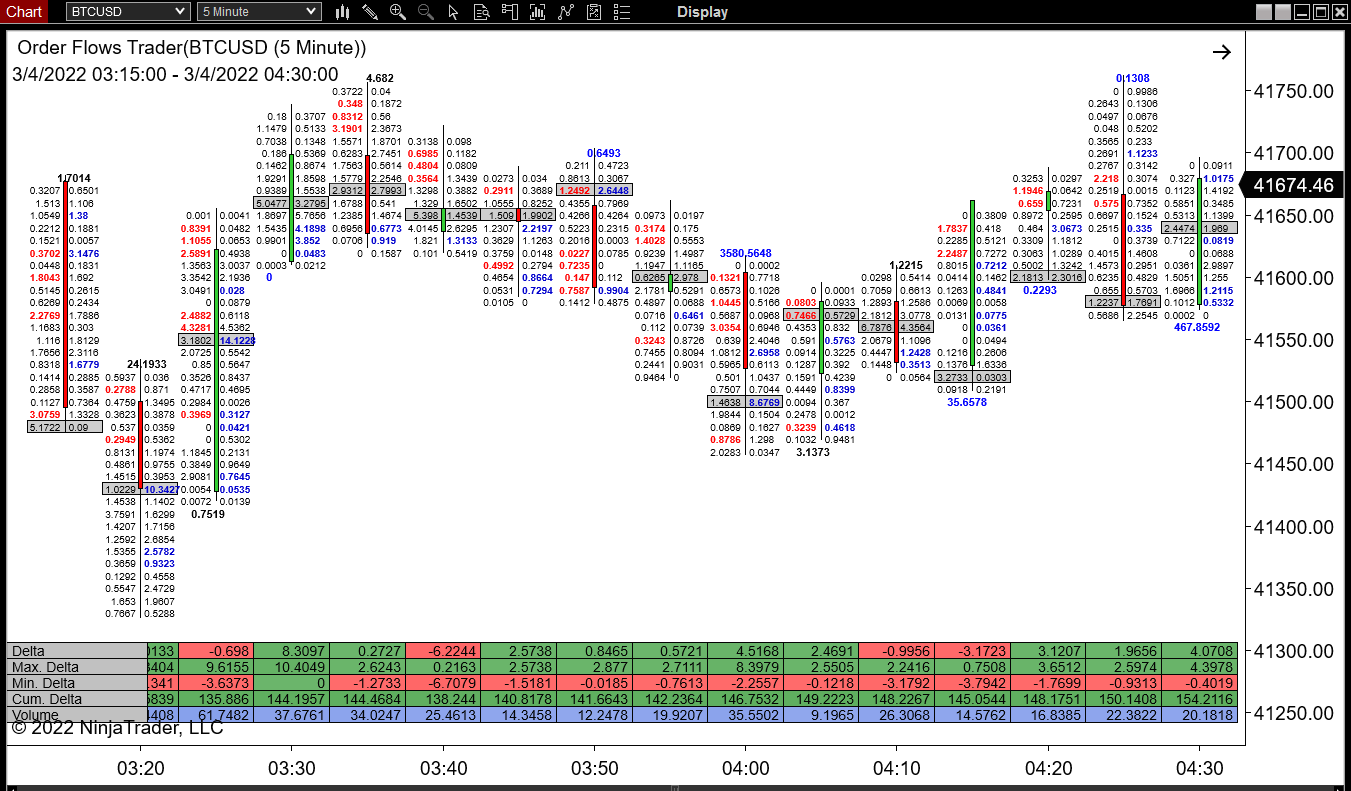

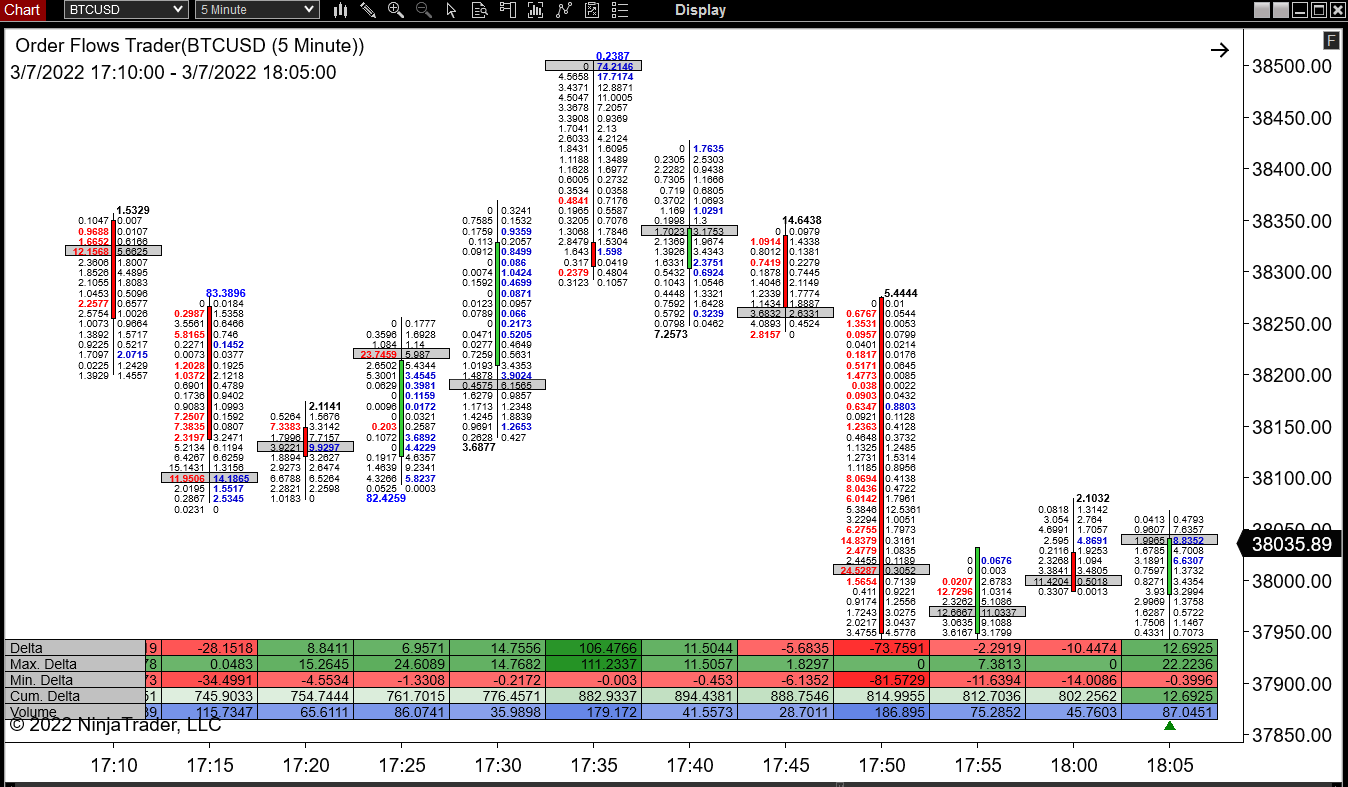

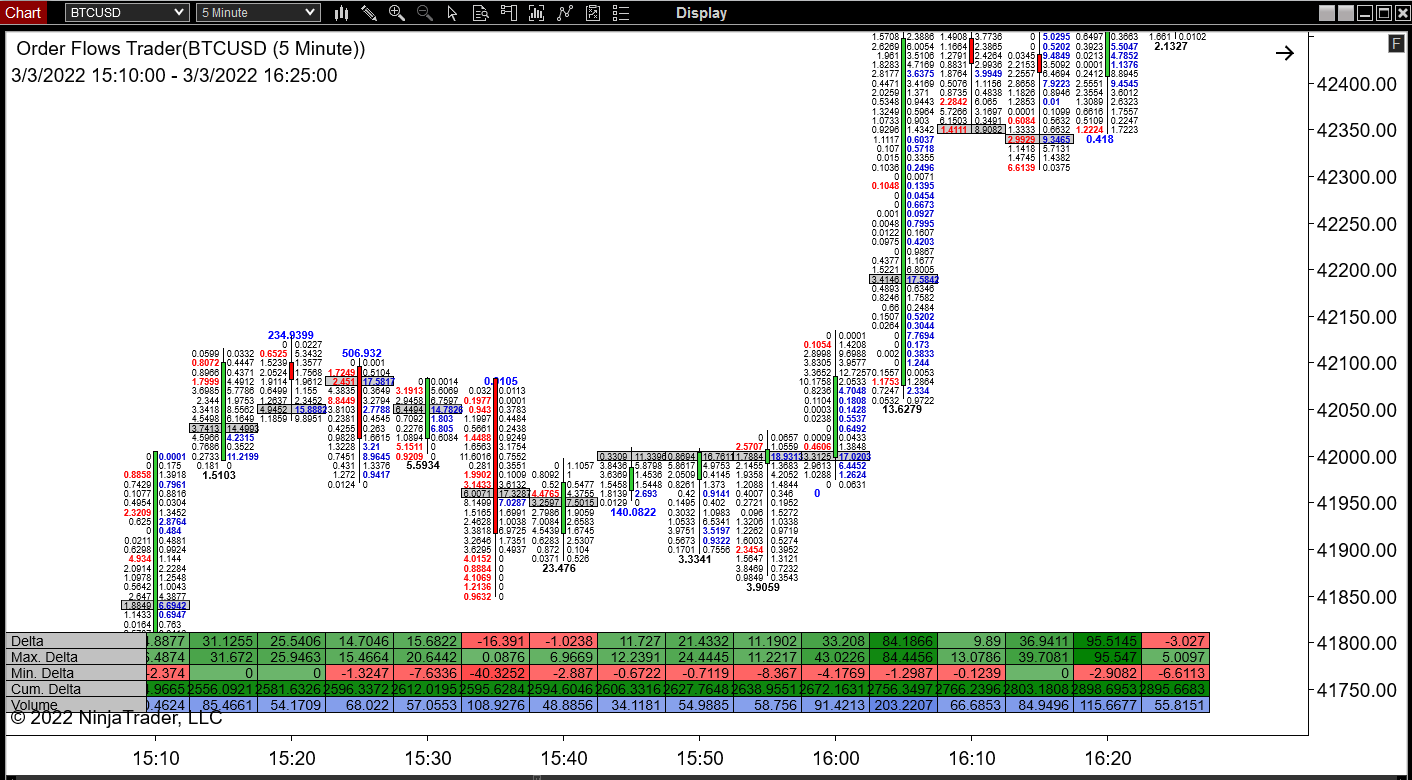

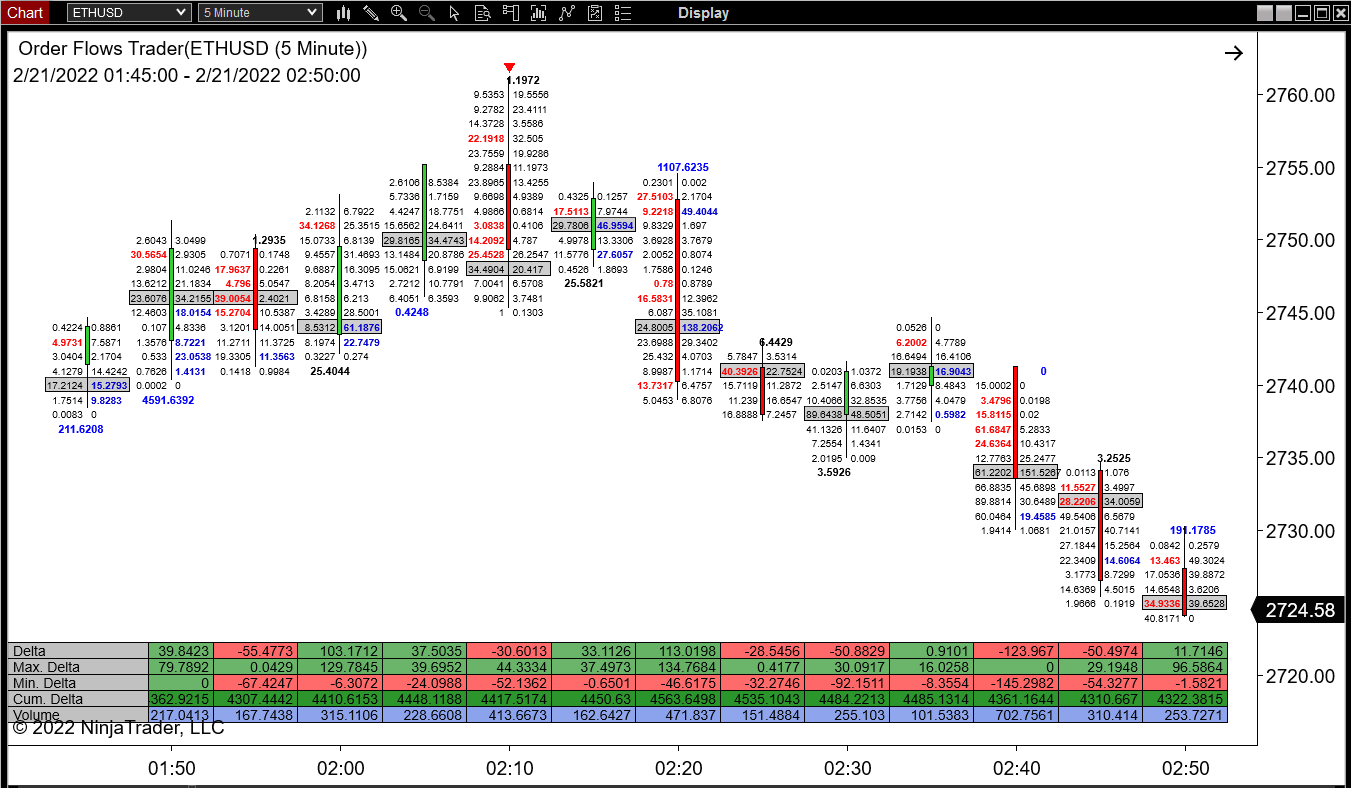

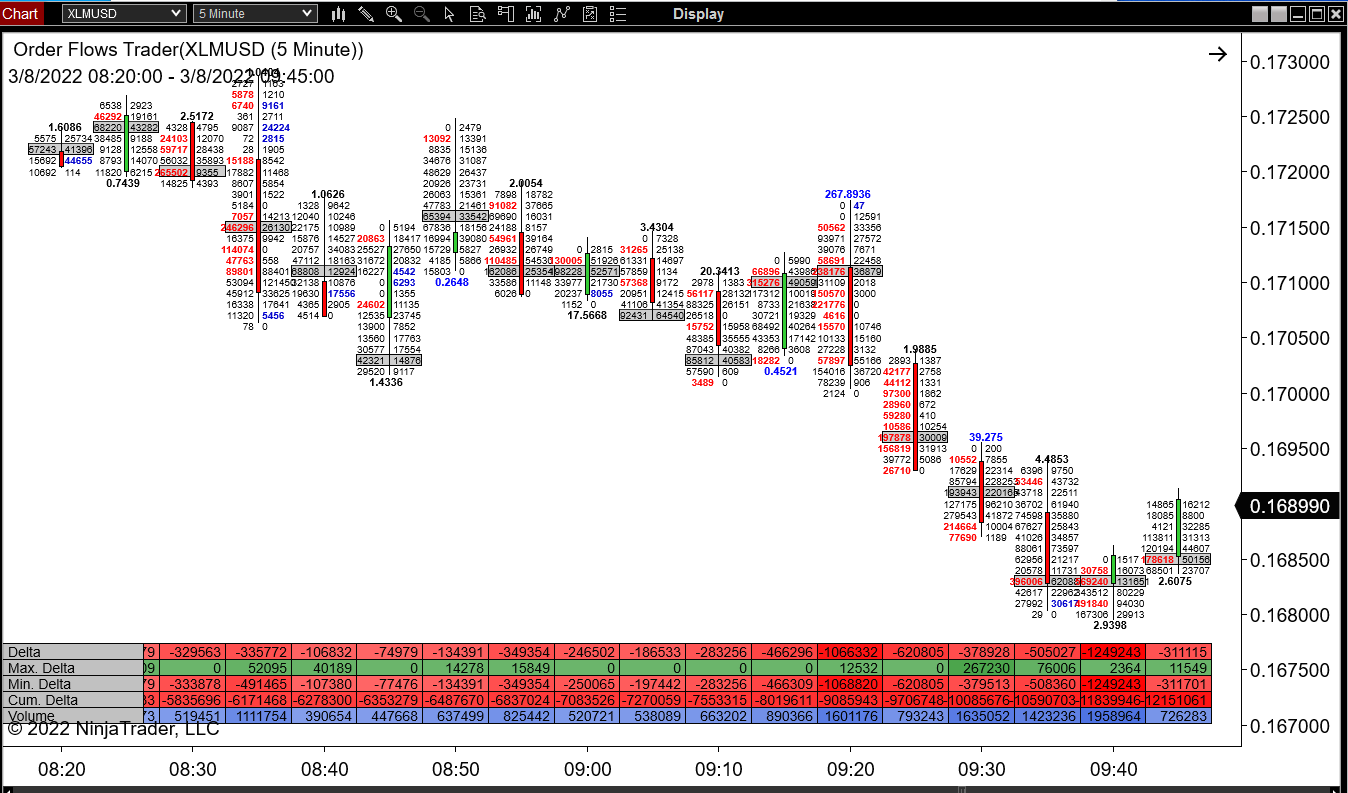

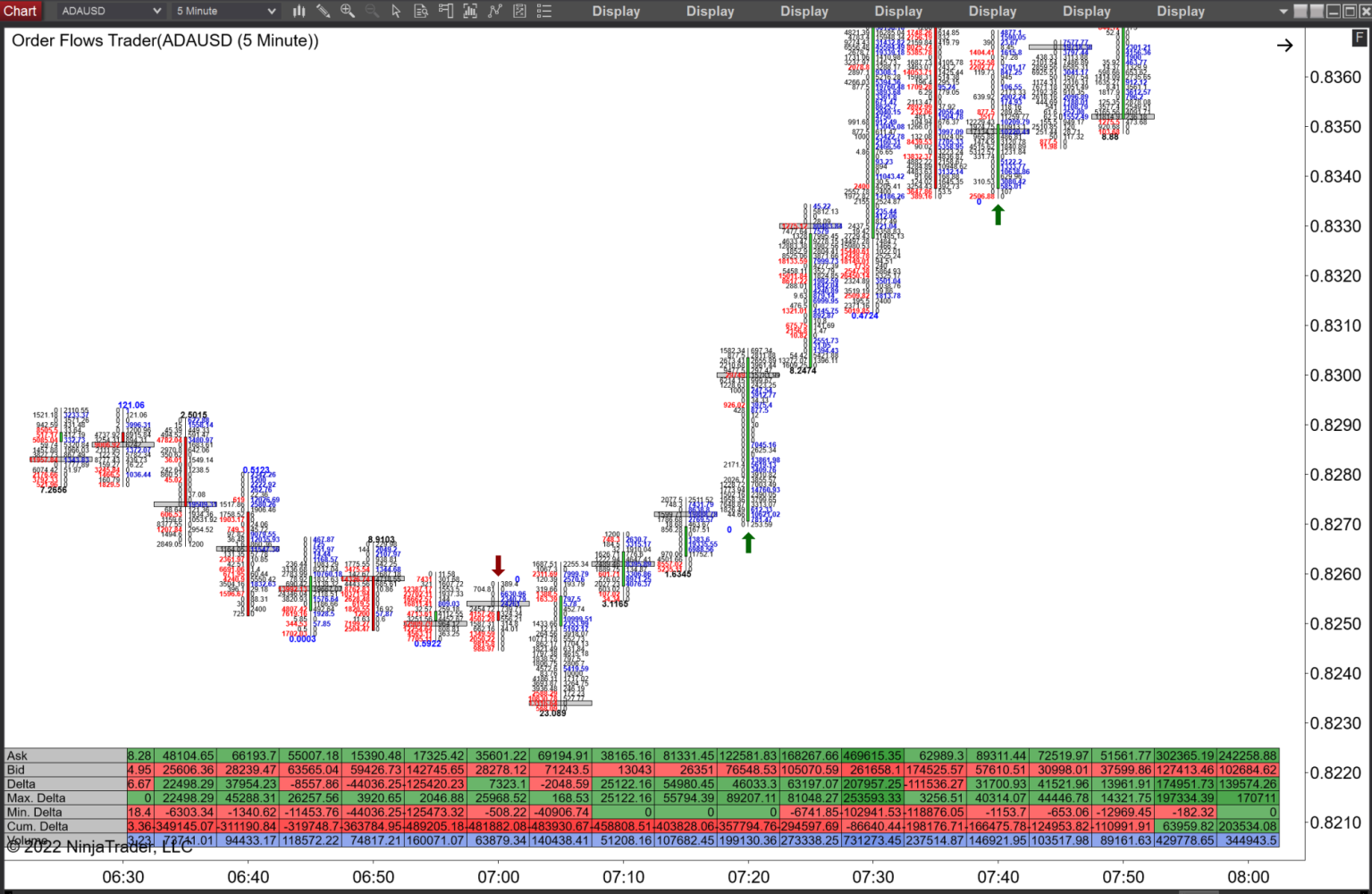

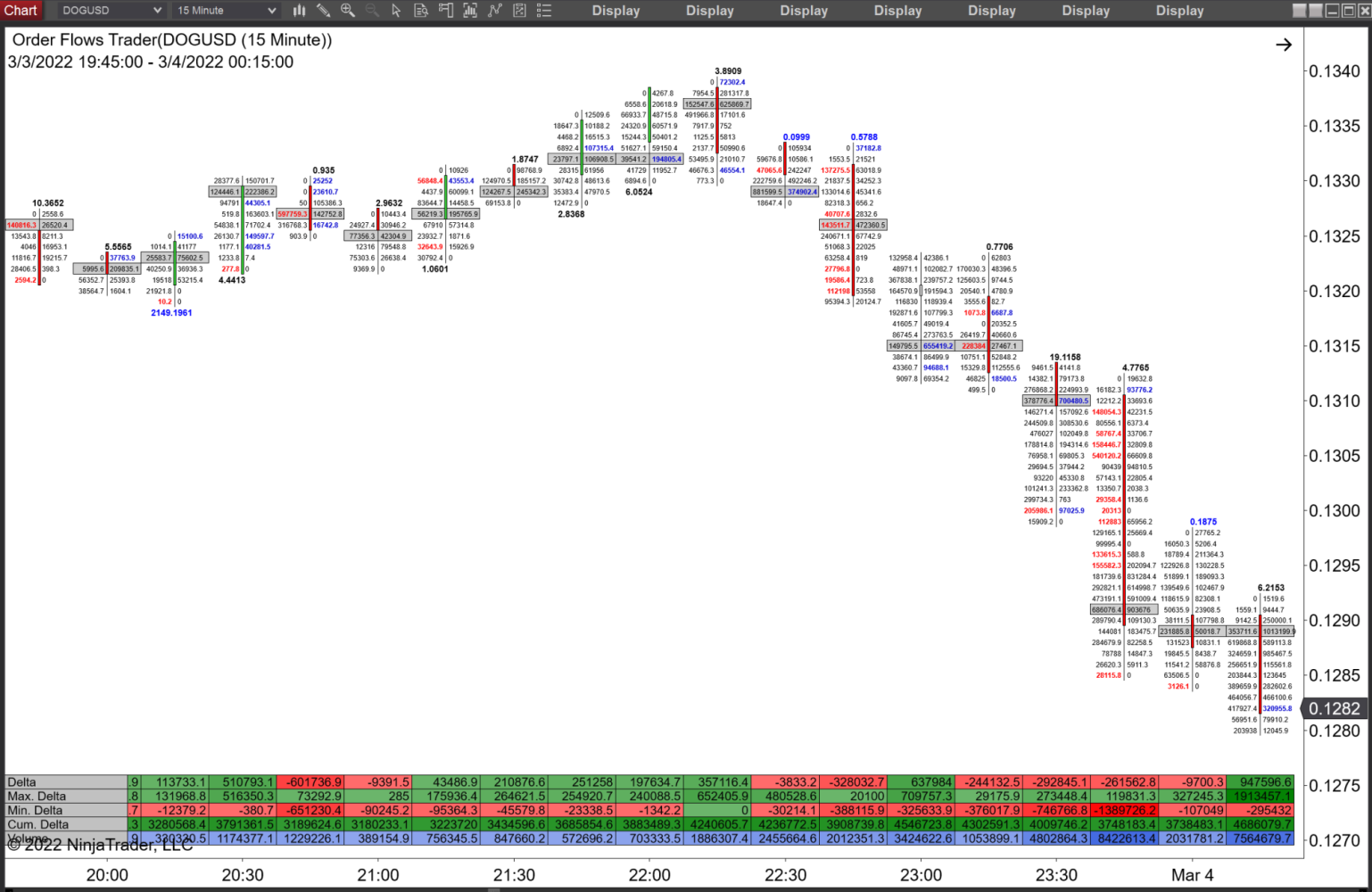

You can use order flow analysis on major crypto such BTC, ETH and even DOGE!

I want to introduce you to my new course:

The Crypto Order Flow Trading Course

The Crypto Order Flow Trading Course

I have taught thousands of traders all around the world how to trade using order flow in the Futures and stock markets. However, many traders wanted to know if order flow could be used in the crypto markets. I am here to tell you, YES, Order Flow Can Be Used In The Crypto Markets.

Order flow as seen through the footprint chart is about taking the information generated from the current trading activity and putting in an easy to read format so that you can see the context of the market.

When you use order flow, you don't have to throw out everything you have learned about trading and the market and are currently using. Instead order flow will compliment your existing method of trading. Whatever approach to the market that you are currently using that makes sense to you and helps you understand the market will be improved upon with the addition of order flow.

Order flow analysis is more powerful than traditional analysis because unlike traditional analysis which shows you where to trade, order flow shows a trader when to trade.

The The Crypto Order Flow Trading Course gives you the understanding of what an order flow chart is, and also takes you on the next step of your trading journey and teaches you what to the look for and what how to put the pieces of order flow together so understanding the market become second nature.

Once you understand the order flow, the power of trading is put back in your hands. You can now start making your own decisions based on what is real, the actual trading taking place, instead of some mathematical massage of price which often is not indicative of what is happening right now in the market.

When traders add various price based indicators to their chart, they are just adding bastardized versions of the same thing. Order flow gives a trader a different dimension into the market.

Order flow analysis lets you come to your own conclusions about the market based on the current trading and market environment.

Order flow as seen through the footprint chart is about taking the information generated from the current trading activity and putting in an easy to read format so that you can see the context of the market.

When you use order flow, you don't have to throw out everything you have learned about trading and the market and are currently using. Instead order flow will compliment your existing method of trading. Whatever approach to the market that you are currently using that makes sense to you and helps you understand the market will be improved upon with the addition of order flow.

Order flow analysis is more powerful than traditional analysis because unlike traditional analysis which shows you where to trade, order flow shows a trader when to trade.

The The Crypto Order Flow Trading Course gives you the understanding of what an order flow chart is, and also takes you on the next step of your trading journey and teaches you what to the look for and what how to put the pieces of order flow together so understanding the market become second nature.

Once you understand the order flow, the power of trading is put back in your hands. You can now start making your own decisions based on what is real, the actual trading taking place, instead of some mathematical massage of price which often is not indicative of what is happening right now in the market.

When traders add various price based indicators to their chart, they are just adding bastardized versions of the same thing. Order flow gives a trader a different dimension into the market.

Order flow analysis lets you come to your own conclusions about the market based on the current trading and market environment.

For many traders, order flow analysis is the missing piece of the trading puzzle.

Order flow is an ocean of information. Some aspects of order flow will make perfect sense to you quickly, while other parts may take you a while to wrap your head around and understand. That is fine. Take your time in your education. Don't drown in the information by trying to use it all at once. See how different aspects of order flow benefit your analysis and grow from there. Trading is a discovery process.

While the order flow answers a lot of questions traders have, order flow answers the most important question: Do buyer or sellers have more conviction right now? Price charts simply cannot answer that.

The Crypto Order Flow Trading Course will get your mind running and give you ideas on how to best utilize order flow in your trading. While it is impossible to show you all the ways you can use order flow, this course provides you the foundation from which you can now start to put your thoughts and ideas about the market into practical use.

While the order flow answers a lot of questions traders have, order flow answers the most important question: Do buyer or sellers have more conviction right now? Price charts simply cannot answer that.

The Crypto Order Flow Trading Course will get your mind running and give you ideas on how to best utilize order flow in your trading. While it is impossible to show you all the ways you can use order flow, this course provides you the foundation from which you can now start to put your thoughts and ideas about the market into practical use.

The Crypto Order Flow Trading Course consists of 20 modules.

Each in-depth training lesson module has a 10-30 minute long video that can be watched on your own schedule. You can move through the training course at your own speed. Watch and re-watch the videos as many times as you please.

Along with the videos, you can also download course lesson PDFs to print and make notes on.

This course is presented in a simple and easy to understand manner. It allows traders an opportunity to learn the key components of order flow analysis and how they can benefit from them.

Along with the videos, you can also download course lesson PDFs to print and make notes on.

This course is presented in a simple and easy to understand manner. It allows traders an opportunity to learn the key components of order flow analysis and how they can benefit from them.

What You'll Learn About Trading Crypto Order Flow...

Module #1 - What Is Order Flow In The Crypto Markets

Module #2 - Order Flow Software & Data For Crypto

Module #3 - How To Read A Crypto Order Flow Chart

Module #4 - Order Flow Terms

Module #5 - Order Flow Delta In Crypto Markets

Module #6 - Order Flow Imbalance In Crypto Markets

Module #7 - Order Flow Point Of Control In Crypto

Module #8 - Market Generated Support & Resistance

Module #9 - Recognize Absorption In Order Flow

Module #10 - Order Flow Accumulation & Distribution

Module #11 - Order Flow Reversals

Module #12 - Order Flow Continuation

Module #13 - Order Flow Breakouts

Module #14 - Order Flow Market Internal Data

Module #15 - Different Order Flow Market Conditions

Module #16 - Momentum In Order Flow

Module #17 - Trade & Risk Management

Module #18 - Crypto Order Flow Trade Setups

Module #19 - Putting It All Together

Module #20 - Crypto Trading Wrap Up

If Order Flow Is So Powerful

Why Am I Revealing It To You Now?

Why Am I Revealing It To You Now?

REASON #1

Because you need to realize that the Crypto Market is extremely big, the market cap is nearly $2 trillion. At the end of the day, you and I are small traders compared to the whales out there. In order to be successful you need to follow what the whales are doing and I want to teach you how to see what they are up to.

REASON #2

Because you might have noticed by now that I love helping people learn order flow trading and hearing their success stories. I have spent 25 years trading at an institutional level and people helped me along the way and this is a way for me to help others. Reading other traders success stories does more for me than any winning trade.

Because you need to realize that the Crypto Market is extremely big, the market cap is nearly $2 trillion. At the end of the day, you and I are small traders compared to the whales out there. In order to be successful you need to follow what the whales are doing and I want to teach you how to see what they are up to.

REASON #2

Because you might have noticed by now that I love helping people learn order flow trading and hearing their success stories. I have spent 25 years trading at an institutional level and people helped me along the way and this is a way for me to help others. Reading other traders success stories does more for me than any winning trade.

Order flow analysis is more powerful than traditional analysis because unlike traditional analysis which shows you where to trade, order flow shows a trader when to trade.

When you know how to trade order flow, you can see the signs in the market before the market moves.

Frequently Asked Questions and Answers:

Q. I signed up and paid my money, now what?

A. We will email your your username and password to access the members area.

Q. How long does it take to get my username and password?

A. It can take anywhere from 1 to 6 hours for your order to be processed. Thank you for understanding.

Q. How Is The Course Delivered?

A. After registering, you will have access to the course area where you can access the lessons.

Q. What Instruments Can I Use With Order Flow?

A. I suggest sticking to the main coins like BTC and ETH. You can trade some of the smaller bigger coins, like ADA, XLM and DOGE. Order flow analysis requires accurate market data and solid volume. I don't recommend trading the pump and dump coins.

Q. Do I need to use the software used in the course.

A. No. There are multiple choices when it comes to which software you can use to plot the order flow footprint chart. I use my own that I developed for NinjaTrader 8, but you can use Sierra Chart, Motive Wave, Quantower and Exochart.

Q. Where can I buy the software you use in the course?

A. You can buy my order flow software, the Orderflows Trader 5.0 from my website, Orderflows.com

Q. I have my own order flow software. How Will This Course Help Me?

A. This course was designed for those who want to learn order flow analysis. Most software vendors do not provide much in the way of training on how to read the order flow. They just sell software and leave the learning up to you.

Q. I forgot my username and password.

A. No problem, just email password@orderflowscrypto.com and I will reissue you credentials to access the membership area.

Q. What chart chart do you use for this course?

A. For the course I use 5-minute order flow footprint BTC charts for uniformity throughout the course. However, you can use whatever time frame you prefer.

Q. Is the information in The Crypto Order Flow Trading Course that same information you teach in your Futures Trading courses?

A. There is some overlap in The Crypto Course and The Futures Course. However, I have made it a point to focus on the parts of order flow that are most beneficial for crypto markets. This is a crypto based market analysis course.

A. We will email your your username and password to access the members area.

Q. How long does it take to get my username and password?

A. It can take anywhere from 1 to 6 hours for your order to be processed. Thank you for understanding.

Q. How Is The Course Delivered?

A. After registering, you will have access to the course area where you can access the lessons.

Q. What Instruments Can I Use With Order Flow?

A. I suggest sticking to the main coins like BTC and ETH. You can trade some of the smaller bigger coins, like ADA, XLM and DOGE. Order flow analysis requires accurate market data and solid volume. I don't recommend trading the pump and dump coins.

Q. Do I need to use the software used in the course.

A. No. There are multiple choices when it comes to which software you can use to plot the order flow footprint chart. I use my own that I developed for NinjaTrader 8, but you can use Sierra Chart, Motive Wave, Quantower and Exochart.

Q. Where can I buy the software you use in the course?

A. You can buy my order flow software, the Orderflows Trader 5.0 from my website, Orderflows.com

Q. I have my own order flow software. How Will This Course Help Me?

A. This course was designed for those who want to learn order flow analysis. Most software vendors do not provide much in the way of training on how to read the order flow. They just sell software and leave the learning up to you.

Q. I forgot my username and password.

A. No problem, just email password@orderflowscrypto.com and I will reissue you credentials to access the membership area.

Q. What chart chart do you use for this course?

A. For the course I use 5-minute order flow footprint BTC charts for uniformity throughout the course. However, you can use whatever time frame you prefer.

Q. Is the information in The Crypto Order Flow Trading Course that same information you teach in your Futures Trading courses?

A. There is some overlap in The Crypto Course and The Futures Course. However, I have made it a point to focus on the parts of order flow that are most beneficial for crypto markets. This is a crypto based market analysis course.

Get Order Flow Trading Course Now for $299 Just $149

Save 50% During This Special Offer

Save 50% During This Special Offer

Once your payment has been processed, your username and password will be sent to the email used to complete your PayPal transaction.

Login credentials are usually generated and sent within 3-6 hours, usually sooner.

Be sure to also check your spam folder.

Login credentials are usually generated and sent within 3-6 hours, usually sooner.

Be sure to also check your spam folder.

Copyright 2022 | Orderflows.com | All rights reserved

Disclaimer All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold cryptos and securities. The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors. RISK DISCLOSURE: Crypto trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. HYPOTHETICAL PERFORMANCE DISCLAIMER:HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..