Unlock Order Flow With The Power Of Point Of Control Course

Learn how successful traders are using market generated information to trade successfully!

Take a look through your trading library. How many books, course and trading indicators have actually provided you with usable information that you have easily incorporated into your analysis and trading plan? How many of those books, courses and trading indicators that you bought were actually written by traders that have actually traded for a living at a professional level? Isn't it about time you took positive action and acquired the practical tools and knowledge necessary for trading?

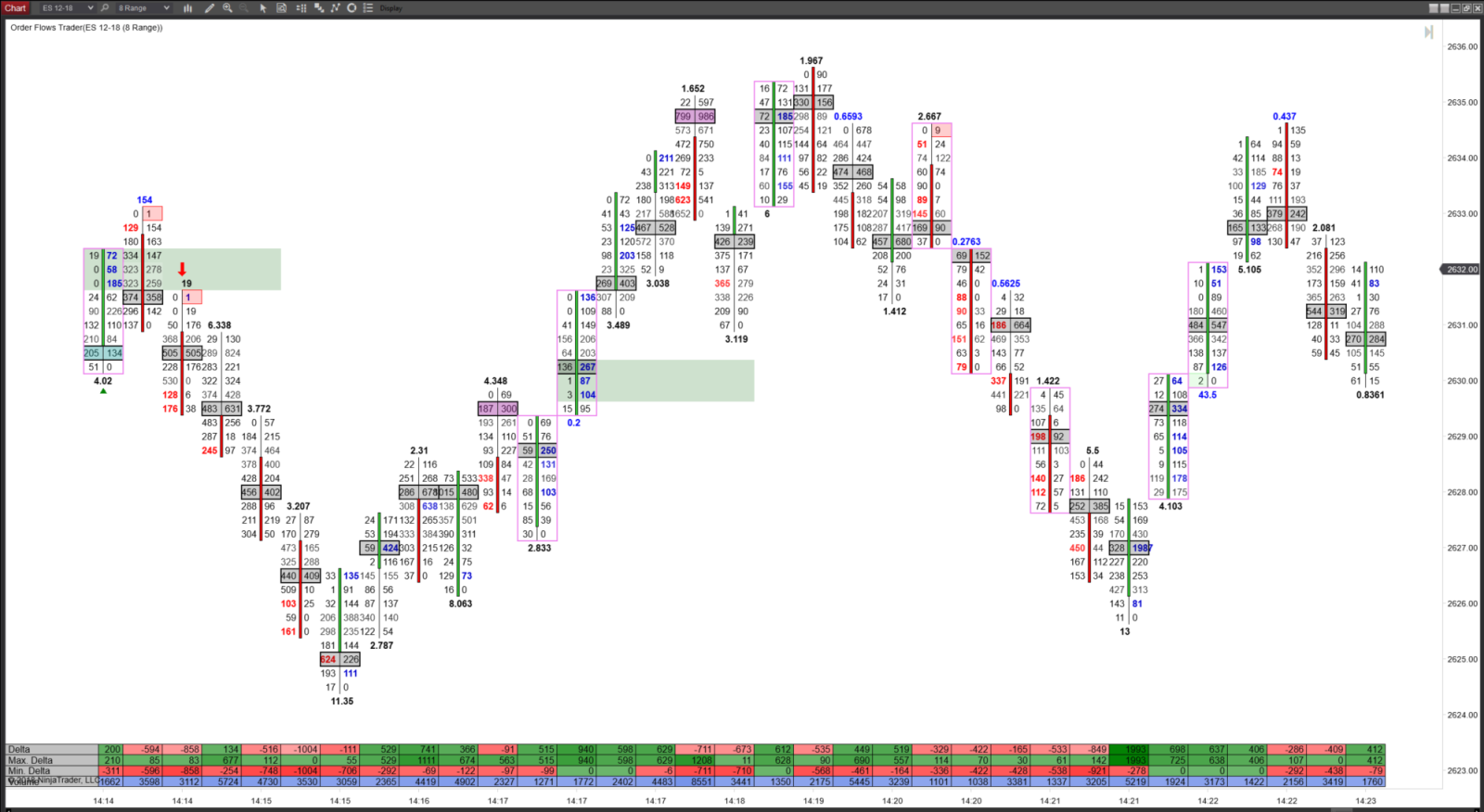

Do You See The Trading Opportunity Presented By Point of Control In The Chart Below?

After a lot of requests I have created a comprehensive training course devoted to understanding order flow Point of Control.

If you trade Futures, Forex, Stocks or CFDs you owe it to yourself to understand Point of Control and how to apply it to your market. Point of Control is the one piece of order flow that works well in Forex, Stocks and CFDs in addition to Futures.

The Power of Point of Control course will expand you knowledge and understanding of order flow Point of Control and give you insight into the markets many traders simply do not have or see.

Point Of Control (POC) in order flow is the price level with the highest volume in a bar. The best way to think of Point of Control is in terms of value. We all know what value, we think about it everyday and don’t even realize it. Whether you are buying vegetables at the grocery market or buying the latest Samsung mobile phone we either accept price or reject it. The markets act the same way with the main difference being that prices are being accepted or rejected much faster and multiple times a day.

You have often heard me talk about how the Point of Control can act as support or resistance in the next bar in a sustained move. However, where the Point of Control appears in a bar is important from a market structure stand point. It becomes clearer when you take it in context of the market. For a market to find support it should preferably come after a move down. To find resistance, the market should have made a move higher.

The purpose of the market is to facilitate trade, but how does it happen? The market seeks out value and moves from value area to value area. In the case of individual bars, it moves from Point of Control to Point of Control.

When market participants accept price, they continue to trade and a Point of Control in a bar is formed. When market participants disagree on price, they reject it and the market looks for the next level of price acceptance.

You are probably wondering “what? Why would the market move to a level of price acceptance then reject it?” The market moves to a level based on the perception of value of different time frame traders. Short term traders have different ideas of what value is compared to long term traders.

Join today to learn A LOT MORE about order flow Point of Control...

If you trade Futures, Forex, Stocks or CFDs you owe it to yourself to understand Point of Control and how to apply it to your market. Point of Control is the one piece of order flow that works well in Forex, Stocks and CFDs in addition to Futures.

The Power of Point of Control course will expand you knowledge and understanding of order flow Point of Control and give you insight into the markets many traders simply do not have or see.

Point Of Control (POC) in order flow is the price level with the highest volume in a bar. The best way to think of Point of Control is in terms of value. We all know what value, we think about it everyday and don’t even realize it. Whether you are buying vegetables at the grocery market or buying the latest Samsung mobile phone we either accept price or reject it. The markets act the same way with the main difference being that prices are being accepted or rejected much faster and multiple times a day.

You have often heard me talk about how the Point of Control can act as support or resistance in the next bar in a sustained move. However, where the Point of Control appears in a bar is important from a market structure stand point. It becomes clearer when you take it in context of the market. For a market to find support it should preferably come after a move down. To find resistance, the market should have made a move higher.

The purpose of the market is to facilitate trade, but how does it happen? The market seeks out value and moves from value area to value area. In the case of individual bars, it moves from Point of Control to Point of Control.

When market participants accept price, they continue to trade and a Point of Control in a bar is formed. When market participants disagree on price, they reject it and the market looks for the next level of price acceptance.

You are probably wondering “what? Why would the market move to a level of price acceptance then reject it?” The market moves to a level based on the perception of value of different time frame traders. Short term traders have different ideas of what value is compared to long term traders.

Join today to learn A LOT MORE about order flow Point of Control...

What You'll Learn Inside...

Module #1 - All About Point Of Control

What you need to know about Point of Control, how it is calculated (spoiler alert, it is easy) and what it really means to traders. Point of Control is an important tool not just for order flow traders but also for any really interested in what is happening in the market.

Module #2 - Viewing Point Of Control

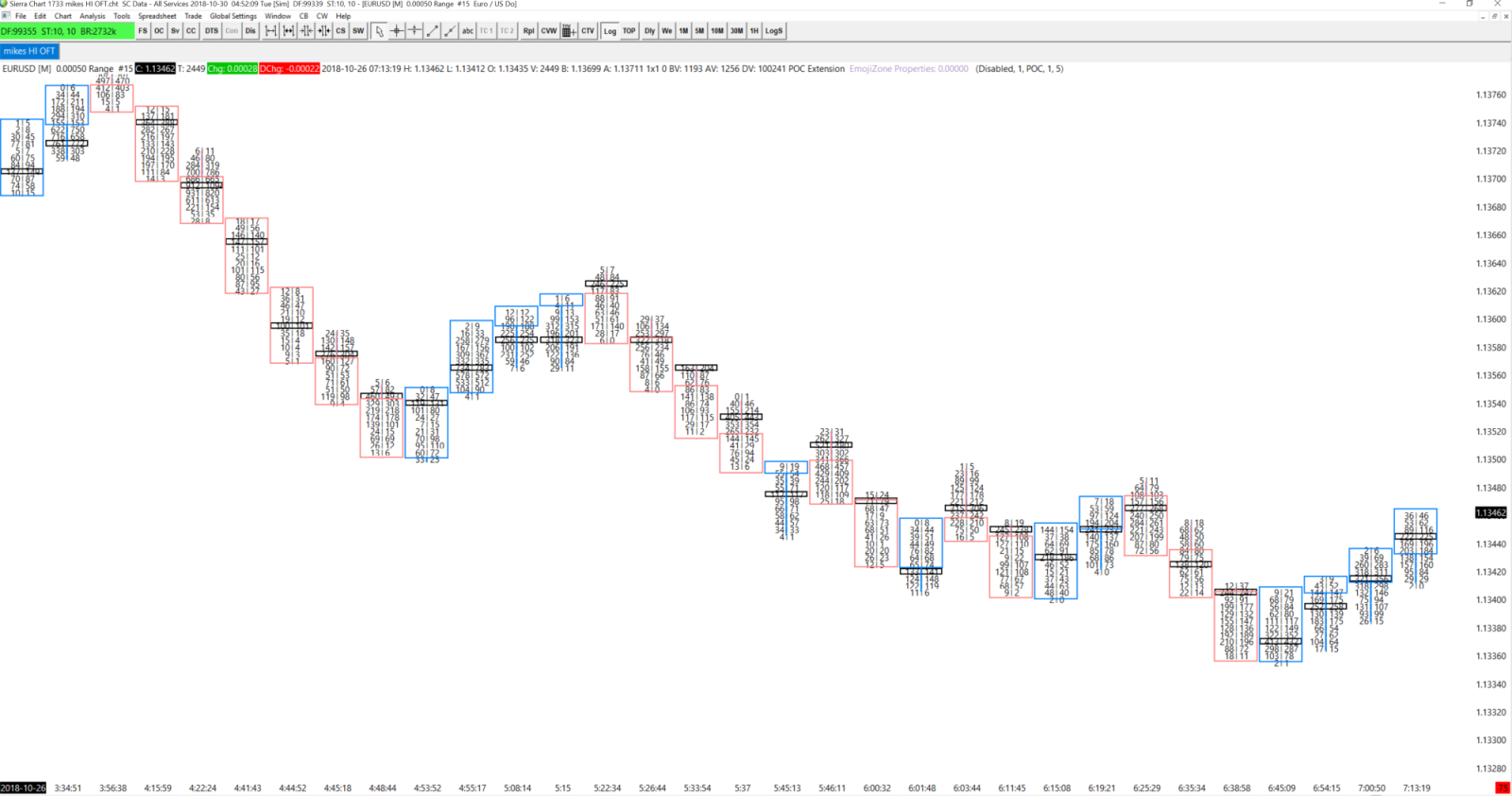

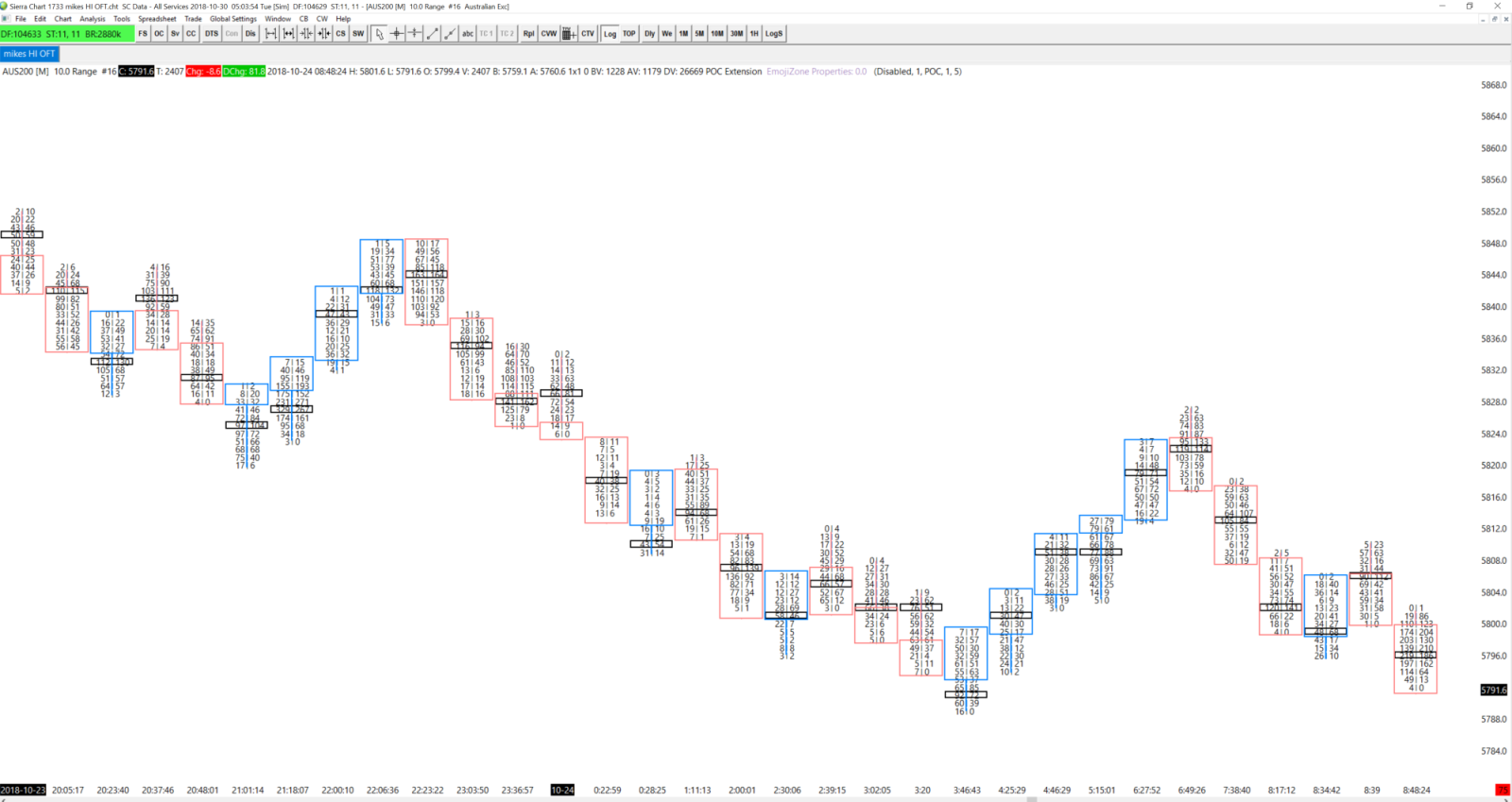

Learn how to view Point of Control. There are many different charting software available to the trader. I use both Sierra Chart and NinjaTrader to walk you through the different features so you can decide how you would like to view Point of Control on your screen.

Module #3 - Point Of Control As Support & Resistance

Discover how you can use Point of Control as support or resistance to find better traders, faster. Once you understand how Point of Control is better than most other forms of support and resistance you will clean up your charts and make your trading easier as you will be using real-time data to see real market generated support and resistance levels.

Module #4 - Point Of Control As Confirmation

Learn how you can use Point of Control as confirmation of market bias and more importantly how to confirm if you are in a good trade or bad trade. Once you get into a trade you have to manage it. Would you rather get stopped out and take a full loss or know how to read order flow so you can get out before your stop is hit?

Module #5 - Point Of Control As Stopping Volume

See stopping volume in the market using Point of Control. Stopping volume occurs are market turning points and is the result of strong passive buyers absorbing aggressive seller or passive sellers absorbing aggressive buyers. What make stopping volume unique is when aggressive traders turn passive buyers. Order Flow and Point of Control help you see when and if that happens.

Module #6 - Point Of Control Setups Part 1

The first 5 of 10 Order Flow Point of Control trade setups explained:

1. Pair Up Point of Control

2. Extreme Point of Control

3. Point of Control In The Wick

4. Slingshot Point of Control

5. Point of Control Wave

1. Pair Up Point of Control

2. Extreme Point of Control

3. Point of Control In The Wick

4. Slingshot Point of Control

5. Point of Control Wave

Module #7 - Point Of Control Setups Part 2

The second 5 of 10 Order Flow Point of Control trade setups explained:

6. Point of Control Migration

7. Point of Control Pullbacks

8. Point of Control Blocks

9. Triple Distribution Point of Control

10. Point of Control Escape

6. Point of Control Migration

7. Point of Control Pullbacks

8. Point of Control Blocks

9. Triple Distribution Point of Control

10. Point of Control Escape

Module #8 - Point Of Control Wrap Up

A wrap up Point of Control for you. To be a successful a trader needs to understand himself, his trading methods and his capabilities with the ultimate goal of using that understanding to improve his trading results. Understanding Point of Control helps you get to where you want to be as a trader.

Point of Control Analysis Works In Futures: ESZ8

Point of Control Analysis Works In Stocks: AAPL

Point of Control Analysis Works In Forex: EURUSD

Point of Control Analysis Works In CFDs: Aussie 200

Get Access To The Power Of Point Of Control Trading Course Now.

Get LIFETIME access for just $199

Get LIFETIME access for just $199

Once your payment has been processed, your log in details will be sent to you via email to the email used to complete your PayPal transaction. All emails are usually sent within 1-2 hours.

Copyright 2019 | Orderflows.com | All rights reserved

Disclaimer

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..