What Makes Orderflows Trader Special?

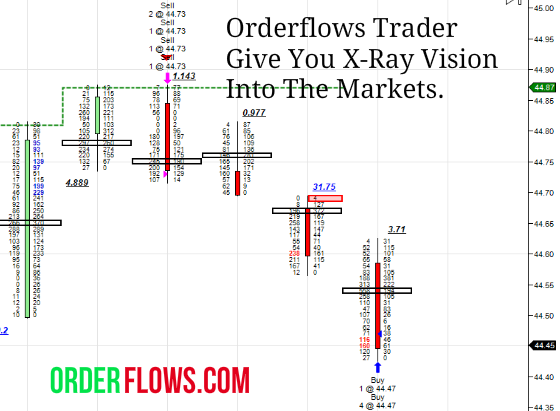

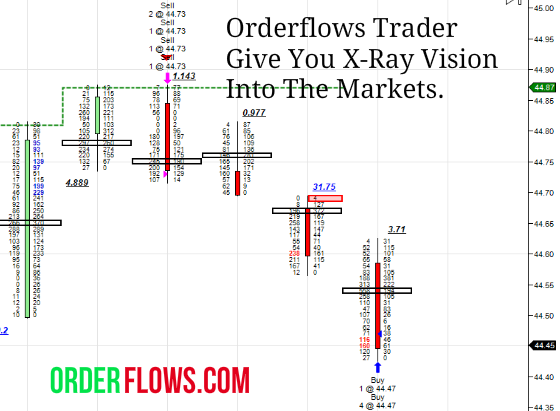

The real power of Orderflows Trader is that it identifies “hidden” trade locations that can’t be seen using traditional charting techniques such as bar charts or candlestick charts. I built my own tools in order to process the order flow as it happens to help find the hidden trade opportunities within a bar. Nothing is more visual and reflects true market sentiment better than the Orderflows chart. Orderflows Trader software identifies key price areas where low risk entry opportunities exist in the market as they happen. It is simple.

The setups are not ambiguous. There is no confusion and no other way to interpret the setup. Jump in and jump out with a profit. Trapped Buyers And Trapped Sellers – If you have ever bought the high of a move you have been trapped in the market and you have to get out with a loss. You know the feeling, all traders have been there. You found the perfect set up only to enter the market and immediately the market moved against you and you were never in the money on your position. It was a loss from the start. These types of traps happen all the time. Orderflows has created the Trapped Buying Imbalance and Trapped Selling Imbalance indicator to highlight on the chart where traders are

potentially trapped. Orderflows Divergence – When the market makes a new high but there were more sellers in the bar or when the market makes a new low but there were more buyers in the bar. This often signals a turning point in the market. The market tried to go higher but couldn’t and was overwhelmed by sellers. The same is true at lows, the market was going lower and lower until the buyers stepped in and overwhelmed the sellers. Orderflows Trader has created the Order Divergence Indicator to highlight on the chart whenever this occurs. Last Buyer / Last Seller – Markets turn when the last buyer has bought or when the last seller has sold. With traditional bar charts you only see the low of the bar or the high of the bar. You cannot judge the internal buying or selling that has been apparent inside the bar. Orderflows Trader has created the Last Buyer and Last Seller indicator to highlight on the chart where their activities are. Big Buyer / Big Seller – There are players in the market who are so big that their actions can determine if a trend stops or starts. These large institutions know market has moved out of supply and demand balance and act accordingly. The beauty of order flow analysis is that their actions can be

seen in the analysis of volume. Orderflows Trader has created the Big Buyer and Big Seller indicator to highlight on the chart where their activities are. Imbalance Support And Resistance – Aggressive institutional buyers and sellers leave their tracks in the market. Their levels of activity often become low risk trade entries when retested. When I say low risk, I am talking like 1, 2 or 3 ticks risk with profit potentials over 10x the risk. Orderflows Trader has created the Imbalance Support and Imbalance Resistance levels indicator to highlight on the chart exactly where these low risk entries are. The real power of these indicators is the stop placements. You can have stops with just a few ticks risk, and take profit levels a few points away. You can’t buy success in the markets. Trading is like any other business. You must have the right tools and right education and learn to make decisions. You cannot simply buy trading software and expect that is all you need to be successful. You must take the time to learn to trade. Now you can learn direct from a professional institutional trader with real market experience spanning twenty years.

|