Introducing

The Volume, Value, VWAP & More

Trading Course

The Volume, Value, VWAP & More

Trading Course

Learn New, Trading Strategies On Volume, Value, VWAP & More

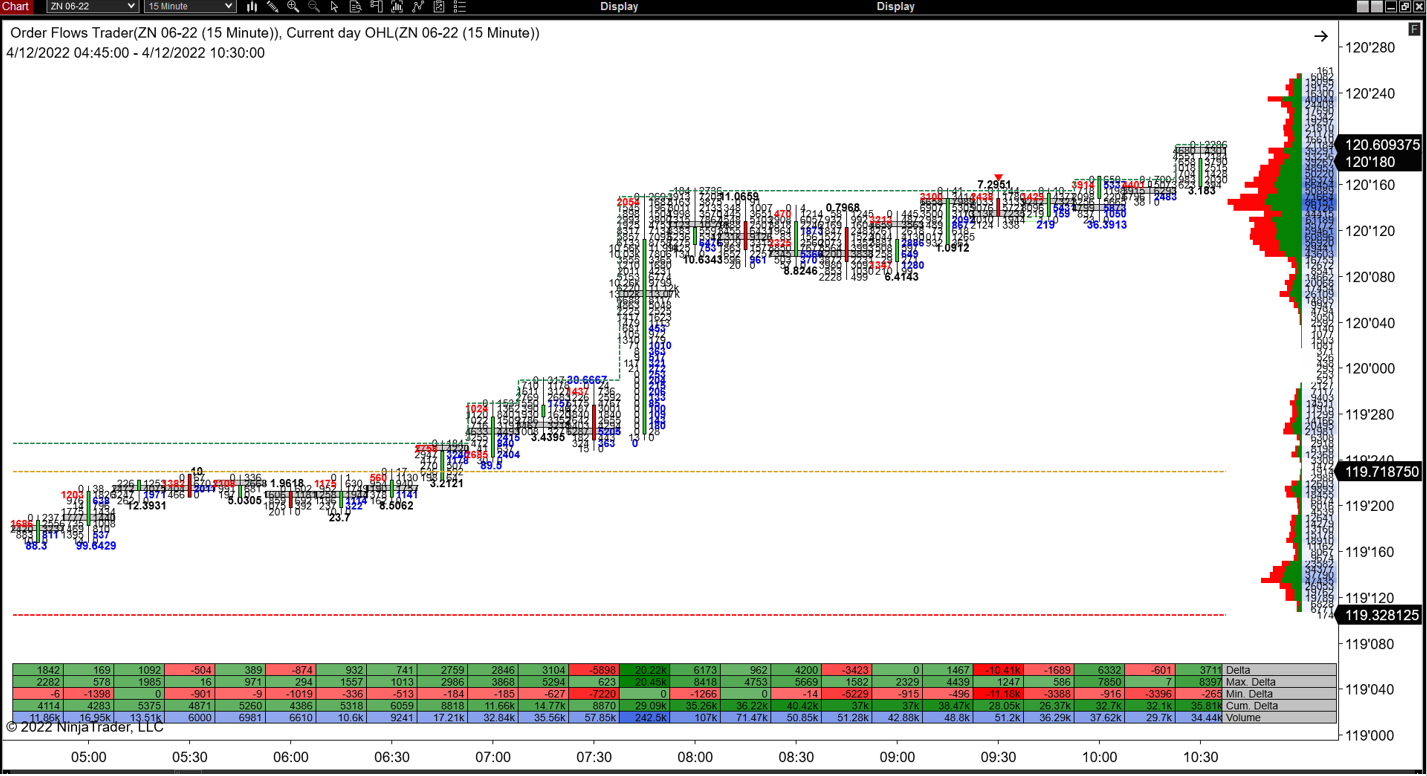

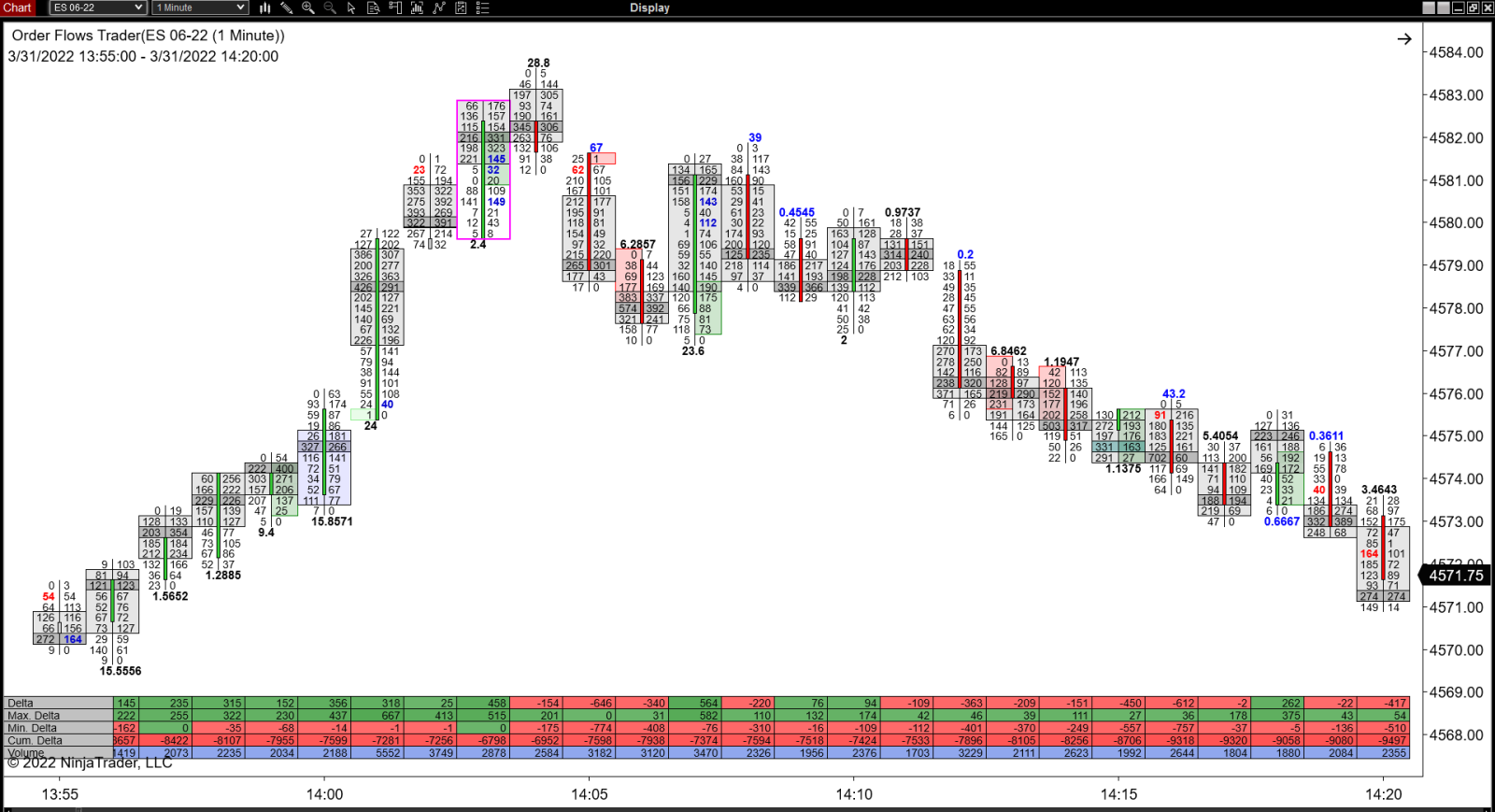

This brand new course is designed for traders who want to improve their knowledge of volume profile trading, VWAP trading, and order book liquidity. The course will cover a range of topics including how to identify trading opportunities, how to manage risk, and how to use effectively use VWAP, volume profile, and order book liquidity to your advantage. Whether you are a beginner or an experienced trader, this course will give you the tools you need to trade with confidence. Get started today and start your journey to becoming a better trader.

WHAT YOU'LL LEARN:

Module 1

Volume, Value, VWAP & More.

Explore Volume, Value, VWAP, and more and learn how they can help you as a trader to make better decisions. Success as a trader hinges on acquiring and applying the right knowledge. Just like any other profession, trading has its own unique set of skills and tools that you need to know in order to be successful. Volume, Value, VWAP, and other concepts are all important when it comes to trading.

Module 2

How To Read The Market Like A Book.

Did you know there are a few things you can do to help read the market like a book/ By understanding volume and price movement can affect trading patterns, you'll be one step closer to becoming a better trader.

Module 3

Limitations Of Price Based Analysis.

Price based analysis is how many traders approach the market and is a cornerstone of technical analysis. However, there are several limitations to price based analysis which traders should be aware of.

Module 4

Understand The Price & Volume Relationship.

It's important to be aware of the relationship between price and volume. Understanding how price and volume interact can help you make more informed trading decisions. Price movements can often be explained by volume changes. When price and volume are considered together, a more complete picture of the market can be formed.

Module 5

Resting Liquidity - How To Capitalize Off It.

By understanding what resting liquidity is and how to capitalize on it, traders can improve their results. In this module, we'll explain what resting liquidity is and discuss how traders can use it to their advantage.

Module 6

How Anchored VWAP Can Help You Trade More Effectively.

Anchored VWAP is a very effective tool for traders that allows traders to get a sense of where the market is heading and make more informed trading decisions. Learn how to use Anchored VWAP effectively in your own trading strategy.

Module 7

What You Really Need To Know About Volume Profile.

Most traders are already familiar with Volume Profile but is underutilized. Volume profile is a powerful tool that can be used to do more than just identify areas of support and resistance in the market. It can also be used to find buying and selling opportunities.

Module 8

Better Ways To Use Volume Profile, Part 1: Value.

In Part 1 of Better Ways To Use Volume Profile, we'll look at value. Value is the most important factor when using volume profile. In order to get the most out of volume profile, it is essential to understand what value means and how to use it correctly.

Module 9

Better Ways To Use Volume Profile, Part 2: Abandoned Value.

In Part 2 of Better Ways To Use Volume Profile, we'll take a look at abandoned value, what it is, why it matters and how to trade using this information.

Module 10

Better Ways To Use Volume Profile, Part 3: Flexible Profile.

In Part 3 of Better Ways To Use Volume Profile, we'll look at flexible volume profile, which allows you to customize your analysis to fit the market conditions. This can help you identify valuable trading opportunities that might otherwise go unnoticed.

Module 11

Recap Of Trade Setups.

The collection of trade setups explained throughout this course in one place plus you will learn new trade setups never discussed before. These trading setups offer a powerful framework for success in today's dynamic market environment.

Module 12

Trading Is Risky.

Anyone who tells you otherwise is not being truthful with you. There is no guarantee that you will make money when trading, and in fact, the odds are generally against you. That said, if you understand the risks involved and are willing to take them on, trading can be a very rewarding activity.

Module 13

It's A Wrap.

Finally, we will recap everything we have learned and offer some advice on how to move forward as a trader. As always, please remember that these are only suggested methods and should not be taken as gospel. Always use sound trading principles when making your own decisions.

Not An Ordinary Trading Course

Trading is a skill that takes time and practice to master. There are many different trading strategies that are explained in this course that can be used to improve your trading. With this knowledge at your disposal, you will be able to take your trading to the next level.

The focus of this course is on the key importance of volume, what to look for in the Volume Profile and how to use it in a meaningful way, how to effectively use VWAP to it for its maximum potential, and when to apply what you see in the resting liquidity to get the most out of it.

The focus of this course is on the key importance of volume, what to look for in the Volume Profile and how to use it in a meaningful way, how to effectively use VWAP to it for its maximum potential, and when to apply what you see in the resting liquidity to get the most out of it.

Yes, I Want To Learn In-Depth How To Use Volume, Value & VWAP

Get Lifetime Access To Volume, Value & VWAP

For JUST... $298

For JUST... $298

Frequently Asked Questions

Q. I am new to order flow, will this course help me?

A. Yes, the order flow trade setups are easy-to-use and more importantly easy-to-spot so that any trader, from novice trader to seasoned trader can use.

A. Yes, the order flow trade setups are easy-to-use and more importantly easy-to-spot so that any trader, from novice trader to seasoned trader can use.

Q. I have purchased your other courses in the past. Is this the same information as taught in those courses?

A. No, this course is completely new. What you will learn has not been covered in previous courses. This course looks at other aspects of trading and order flow not discussed in my other courses.

A. No, this course is completely new. What you will learn has not been covered in previous courses. This course looks at other aspects of trading and order flow not discussed in my other courses.

Q. What software comes with this course?

A. None. There is no software included with this course. This course was created to teach you to use the order flow, volume profile, and VWAP tools on the software you already own or plan to purchase in the future. Most trading software have these tools available.

A. None. There is no software included with this course. This course was created to teach you to use the order flow, volume profile, and VWAP tools on the software you already own or plan to purchase in the future. Most trading software have these tools available.

Q. Do I need to use your Orderflows Trader 5.0 to see these setups?

A. No, you do not need to use Orderflows Trader 5.0 or NinjaTrader. You can if you want, but I have designed this course so anyone using any trading software that has order flow, volume profile, VWAP tools on can look for these setups. This course is not software specific. Most trading software have these tools available.

A. No, you do not need to use Orderflows Trader 5.0 or NinjaTrader. You can if you want, but I have designed this course so anyone using any trading software that has order flow, volume profile, VWAP tools on can look for these setups. This course is not software specific. Most trading software have these tools available.

You are now just one click away from the Volume, Value and VWAP Members Area and discovering how powerful the revealed strategies really are.

Click the button above and get started today, I am sure you won't regret it.

I am looking forward to see you on the inside!

Click the button above and get started today, I am sure you won't regret it.

I am looking forward to see you on the inside!

Michael Valtos

Copyright 2022. Orderflows.com. All rights reserved.

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..